by Bryan Perry

March 11, 2025

Amid all the on again/off again tariff posturing that has the U.S. equity market seemingly in total chaos, I’m pleased to say that the bond market has rallied sharply, drawing capital flows into assets that have reliable balance sheets. Even as some of the most beloved momentum stocks retreat as much as 30% to 50% off of their recent highs, there is a welcome calm within the debt and credit markets.

The tariffs, and much of President Trump’s other first-100-day agenda items, have rattled the markets. It’s like swallowing that bad-tasting medicine to address all the issues that the President campaigned on. Markets are worried that tariffs will hinder growth and trigger new inflationary pressures.

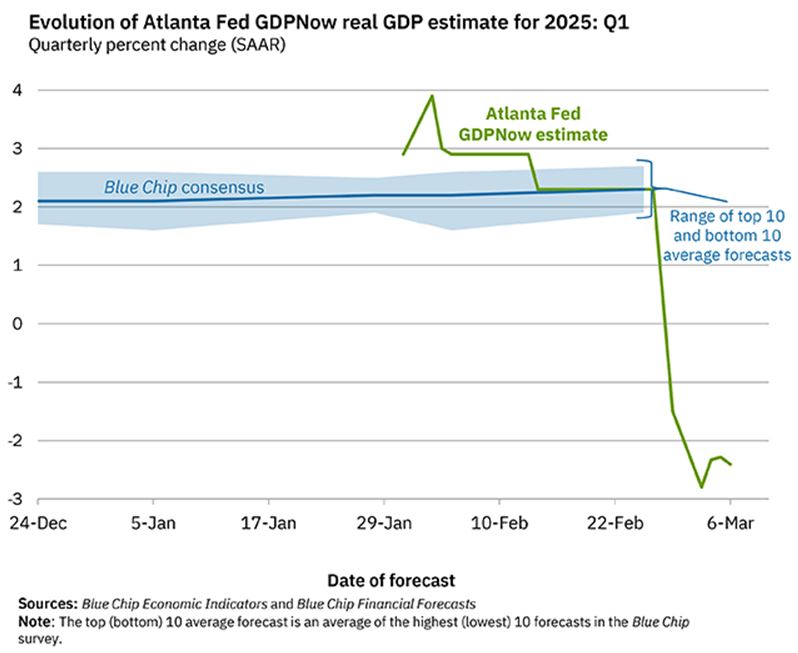

The Atlanta Fed GDPNow estimate for the first quarter of 2025 has been revised sharply lower to -2.4 percent from -2.8 percent on March 3, but down from a +3.8% growth rate posted on January 30. This is a huge series of revisions with recent economic data not supporting such massive swings in their forecast.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The old saying that “markets hate uncertainty” is the operating phrase recently. While some things are uncertain from a policy perspective, what is certain is that exports account for a whopping 20% of Canada’s GDP with 78% of Canada’s exports going to the U.S. Additionally, exports play a significant role in Mexico’s economy, accounting for over a third of its GDP. Of these exports, more than 80% are directed to the United States. Conversely, U.S. exports to Canada make up just 1.5% of U.S. GDP and exports to Mexico make up only 1% of U.S. GDP, so it seems that U.S. markets may be overreacting.

For now, the air is thick with consternation, but the motivation is for Canada, Mexico and Europe to reach agreements on more equitable tariffs and a solidifying of the borders, plus finding ways to support Ukraine from Europe, as the U.S. has done most of the heavy lifting in the first three years of this war.

Last year, the U.S. spent approximately $1.16 trillion on interest payment for its national debt, which has soared well above the U.S. defense budget, which stands at $850 billion for fiscal 2025. As of January 2025, the U.S. national debt stands at over $36 trillion. Because of concerns related to tariffs, inflation and the downsizing of decades-long bloated government, it sure seems like the investment community has decided once again not to take the unsustainable federal debt bomb seriously, due to market volatility.

I believe that most of those that read our weekly Market mail columns are of the “old school” view that debt matters: If your own house (budget) isn’t in order, you know there can be serious consequences. This current 7% pullback in the S&P 500 and 10% correction in the Nasdaq are nothing compared to what could happen if there were no coordinated plan to balance the budget first, and then working on a plan to reduce the federal debt. There is a time to spend money, and a time to save money. The U.S. government has done a terrible job of not saving and paying down debt during good times, and this must change now.

The Latest Economic Data Reminds Us: Now is the Time to Initiate Change

The February employment data came in Friday, with the unemployment rate rising to 4.1% from 4.0% in January. The effects of the government DOGE job cuts will likely show up more in the March and April data, and the latest ADP report showed the number of future job openings shrinking, month-over-month. This translates to a softer labor market that brings down inflation but also dampens consumer confidence.

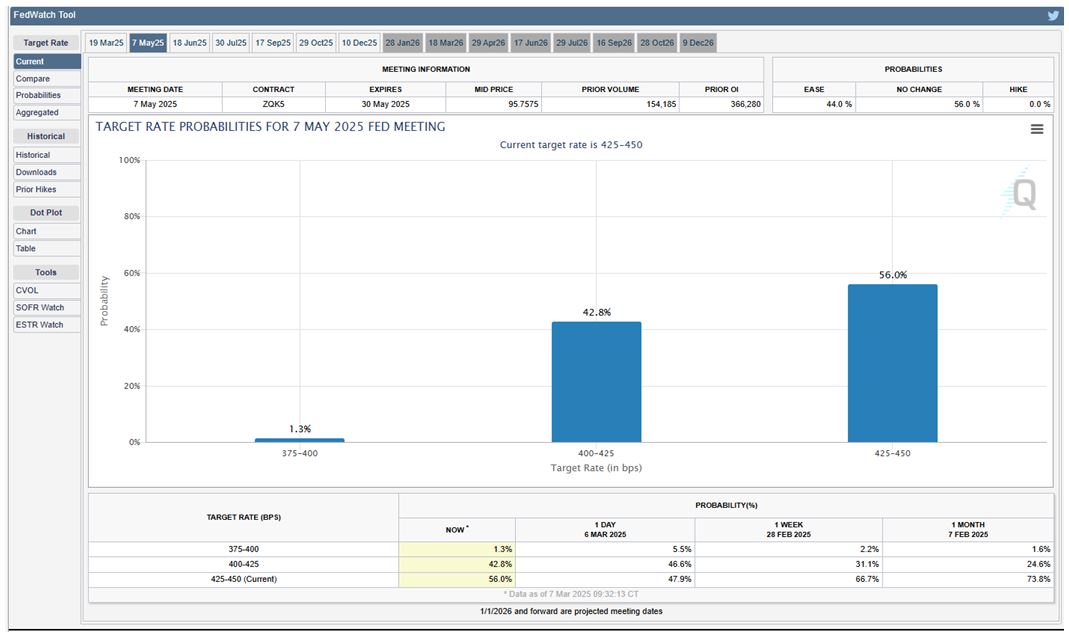

The latest CME FedWatch Tool reading shows the probability of the Fed cutting the Fed funds rate by a quarter point in May has risen from 31% a week ago to 43% now. This week’s inflation data will provide more impetus for moving those odds up or down. The anecdotal evidence definitely points to lower consumer spending. The bond futures market is now pricing in three rate cuts by year-end – a complete turn of sentiment from the “no rate cut” narrative that was the accepted position just three weeks ago.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The pronounced selling pressure in the equity markets reflects an attitude of uncertainty that leads to caution, which is fueling the bond market rally. The stock market will be on the defensive over the near term. However, if the economy were heading toward a recession, the spreads on non-investment grade bond yields would be widening (in their bid and ask spread), and this is not anywhere near the case. High-yield bond spreads are tight, very tight, which in my opinion is a buy signal for stocks.

Treasury Secretary Scott Bessent recently referred to the U.S. economy as entering a “detox period,” which refers to a transition from heavy government spending to increased private sector activity. He emphasized that the economy has become overly reliant on public sector spending and stimulus, and this adjustment might lead to temporary slowdowns in parts of the broader economy. The offset will be the Fed aggressively lowering interest rates over the balance of 2025 – and well into 2026.

Again, the bearish canary in the coal mine of a future recession would be the widening of credit spreads in the high-yield fixed income and senior loan markets. As of last week, these markets have been very stable, coupled with a strong tailwind to the back of the Treasury market, with the 10-year T-Note yield having rallied by seeing yields drop from 4.8% to 4.3% in the first quarter of 2025.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The market caught a bid last Friday when Fed Chair Jerome Powell basically stated that the economy is in a good place, with the Fed seeing no urgency to change its policy directive.

A couple of facts in closing. There are three million federal employees. For every federal government employee, there are two federal contractors, meaning that the entire federal government is made up of roughly nine million people, with the U.S. labor force standing at roughly 160 million workers.

Those that lose their jobs within the federal government will have to find work in the private sector. Corporations cut and build all the time. The road ahead won’t be full of punch bowls and stimulus, but the way forward will prove to be very reassuring for our credit markets and, ultimately, for equity markets.

The post 3-11-25: Buy When There Is Tariff and DOGE-Cut “Blood in The Streets” appeared first on Navellier.