by Jason Bodner

March 11, 2025

In 1841, Charles Mackay wrote “Extraordinary Popular Delusions and the Madness of Crowds,” a thick read, but important in understanding the human mind’s approach to investing.

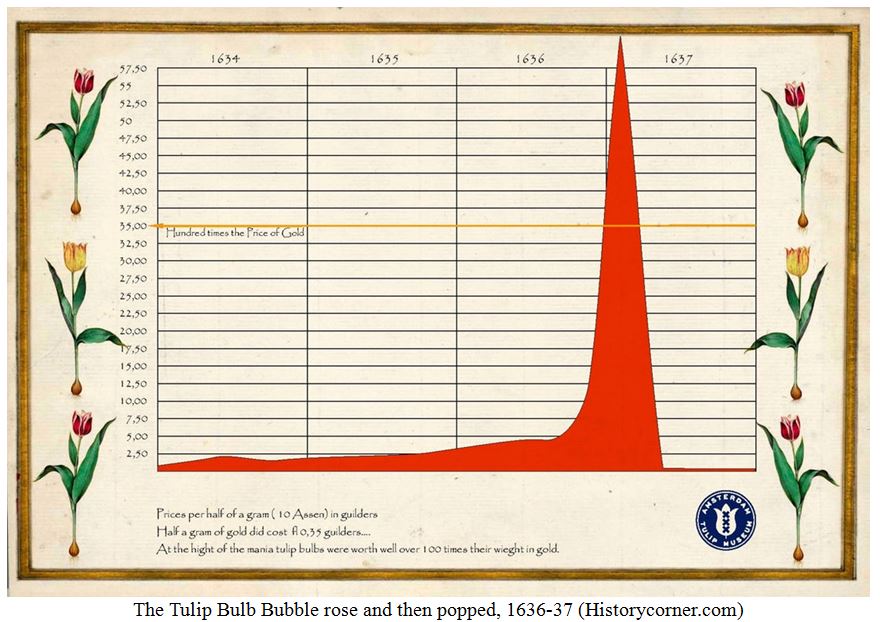

One of those delusions is the 1630s Tulip Mania. Tulips became the ultimate status symbol. A single rare bulb was so valuable that it cost as much as a luxurious Amsterdam house. All speculative bubbles pop. Tulip prices crashed virtually overnight, and many investors were left financially ruined:

Not all manias are financial. There’s also the Dancing Mania of 1518, when Frau Troffea, a woman in Strasbourg (in modern-day France) suddenly began dancing in the streets and couldn’t stop. Within days, dozens of people joined her, twisting as if possessed. After a month, there were hundreds of dancers.

Doctors and authorities had no clue as to what was happening. They encouraged more dancing, hiring musicians, thinking it would cure the problem. It didn’t. People collapsed from exhaustion, dehydration, and some even died from heart attacks and strokes—literally dancing themselves to death.

The dancing madness continued for months before finally fading away as mysteriously as it began. Some blamed food poisoning. Others blamed demonic possession. We’ll never know. My point is that these stories highlight the fact that herd mentality can yield unfortunate consequences – even in stock markets.

Investor crowd-think can lead to disastrous consequences. Countless historical bubbles have ruined investors – the internet bubble, the housing bubble, crypto and meme stocks…. The list goes on.

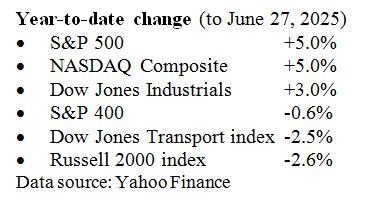

To be clear, I don’t think we are in a bubble right now, or recently, but there has been a sudden shift in sentiment in the last few weeks. The crowd went from giddy to paranoid in just a few days.

Let’s investigate why I think fear has gripped the wheel – but logic will prevail in the end…

The post 3-11-25: Are We in the Midst of a Bubble Mania (the Madness of Crowds)? appeared first on Navellier.