by Ivan Martchev

March 4, 2025

The S&P 500 registered a second down week in a row after hitting an all-time high as recently as February 19th. Even with the all-time high set in February, we ended with a down month, as most of the damage was done in the last seven trading days of the month, flipping the index from positive to negative for February. The most positive thing we can say about February is that we finally had the first rising Friday of the Trump administration – after experiencing five negative Fridays in a row prior to that.

While the S&P 500 Index ended up down two weeks in a row, we have not seen three down weeks in a row since last August. Meanwhile, the U.S. Treasury market’s yield dropped five weeks in a row, which is even more telling. Treasury yields have now declined almost 60 basis points from their January highs. Individual investors don’t follow bonds as closely as stocks, but to a bond trader or institutional investor this move in Treasuries is similar to the stock market moving 5%.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This sharp drop in Treasury yields is causing a yield curve inversion to some short-dated Treasury notes. While the famous 2/10-year spread is not inverted yet (3.99% vs. 4.24%), the 3-month is inverted, as the 3-month note yield (4.32%) is now higher than the 10-year note. A deeper inversion of those spreads, particularly if the 2-year inverts, will signify that an economic slowdown is worrying the bond market.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

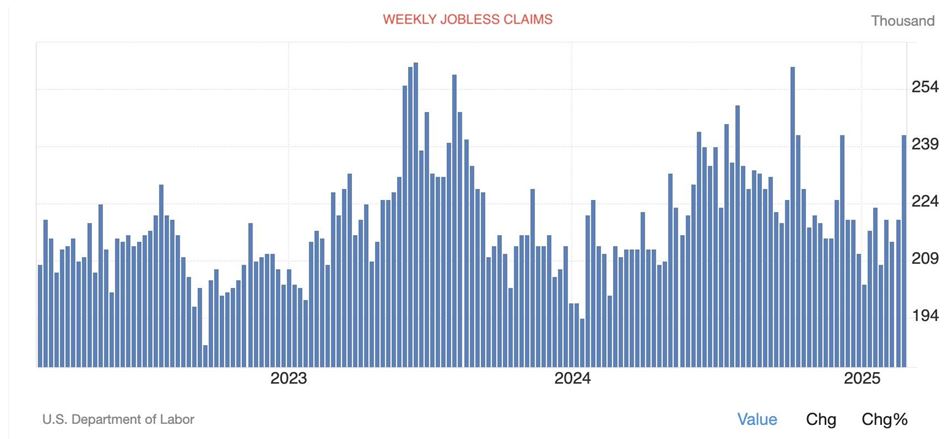

One day does not make a trend make, but we saw the first spike in weekly jobless claims last week at 242K. Needless to say, this is not a weak number, as we have not seen any sustained numbers above 250K since COVID ended, but it is a number which will be more closely monitored throughout March. This trend also puts more weight on the February payroll report, which is due this coming Friday.

My guess is that much of the slowdown may be seasonal, as we had some really cold weather in January, which tends to depress consumer spending and cause temporary economic weakness. As the weather gets better, such weakness is likely to revert to the mean. It is too early to extrapolate this weakness into a bigger trend. Much of the volatility in the stock market of late has been tied to policy changes from Washington rather than economic news, and it can probably turn on a dime if the news flips to positive.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

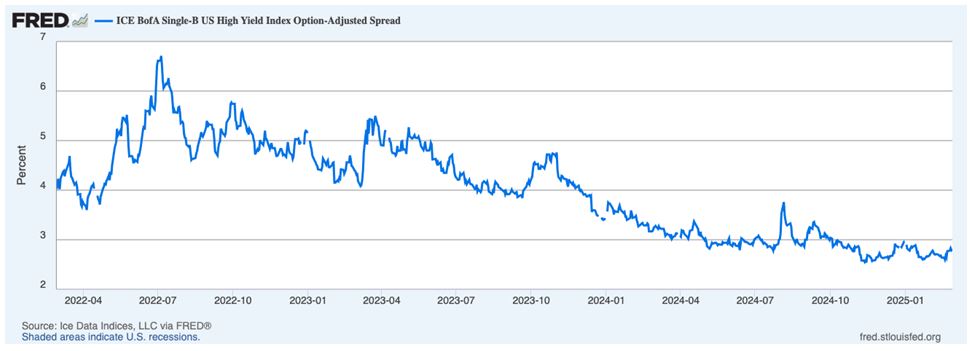

While Treasuries may be rallying and their yields may be falling in some sort of mild burst of panic, with investors reacting to tariff headlines and a few spotty economic statistics, riskier bonds are more or less yawning at the mild investor panic. Single-B rated junk bonds show spreads to relevant Treasuries of 2.81%. For comparison, during a time of more worried bond investors last summer, those spreads were near 3.80%, when the 10-year Treasury was near 3.60%, a long way from here. (Anything below 4% on the single-B spread, which bond traders call “inside 400” (basis points) is considered a sign of a healthy economy and not a reason to worry, so, on that basis, there is no sign of a weakening economy here).

Finally, let’s not forget that February and September are particularly bad months for the stock market, on average, over the last 100-years of data. Last year, both February and September turned out to be rising months, but this year we may revert to normal seasonality, starting with January and February being true to form. In that case, it is worthwhile pointing out that March, April and May tend to be seasonally strong.

The post 3-4-25: The Bond Market Is Beginning to Worry (a Little) About the Economy appeared first on Navellier.