by Ivan Martchev

February 25, 2025

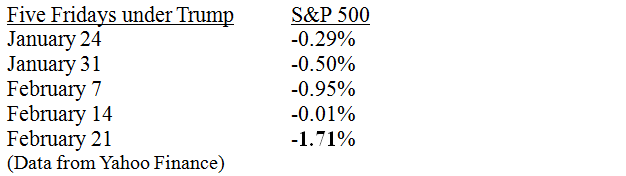

Every Friday of the new Trump administration has been a down day, if you look at the most important index, the S&P 500. The first three Fridays were down more each week until Valentine’s Day, the 14th, was down only marginally, but last Friday was down a giant step.

Why such a downward trend? Isn’t President Trump trying to unleash the potential of the U.S. economy?

He is, but between tariff tweets (read: aggressive trade negotiations) and overdue federal government cost cutting, there will be some pain before there is some long-term gain. When I stated in this column before President Trump took office that I expected a positive environment in 2025 but with higher volatility due to his policy agenda, this is precisely what I meant, even though I am surprised by how fast he is moving, which results in even higher volatility, but he knows this is his last term, so he has no time to lose.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

What has become painfully obvious since early December – about a month after his election victory – is that there are stock sellers near 6,100 on the S&P 500. For the 2-⅓ months since then, every time the index nears that level, whether below or a little above, a sharp sell-off materializes. I do not believe this is a coincidence. Big portfolios have big gains to protect in the last two years and they would rather let Mr. Trump get some policy wins and let the smoke clear before they commit in this time of rising uncertainty.

The 200-day moving average in the S&P 500 is at 5701.50 and rising, as of Friday. We never touched that 200-dma in 2024, so we are due for a correction towards that moving average, which is another way of saying that this is a very strong rally. Whether we see this correction in February or March is dependent on multiple policy announcements by the White House, which can happen very fast – by either economic or geopolitical developments. The White House has been the primary driver of volatility in stocks, so it is hard to predict with certainty even on a short-term basis, which is exactly the uncertainty the President wants to create in order to put himself in a better position to achieve his desired outcome.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

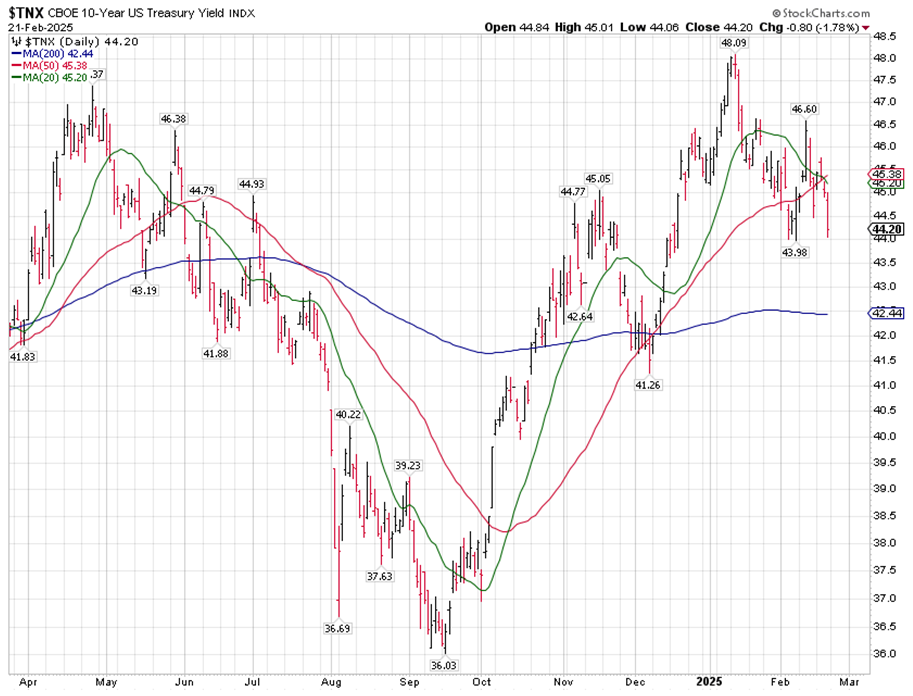

The stock market is no longer worried about rising Treasury yields but more about a slowing economy. The 10-year Treasury yield closed on Friday at 4.42%. If it starts trending lower after the fastest spike in Treasury yields after a Federal Reserve Fed funds rate cutting cycle began – which we just experienced – it would solidify the view that the economy becomes the primary concern for investors, not inflation.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Investors are worried that the Trump administration wants to cut $2 trillion out of federal government spending by mid-2026. The goal is to balance the federal budget as fiscal 2024 produced a deficit of over $1.8 trillion – the worst since the COVID years of 2020-21. Surely Mr. Trump would like to see a balanced budget without inducing a recession, which in and of itself tends to push the deficit higher.

There is no quarrel that the federal government is bloated and that there is waste in Washington, but the simple reality is that this deficit money that flows into the U.S. economy will be missed. Not all of it will disappear, as federal workers get new jobs and businesses take over activities previously funded by the federal government, but passing the baton seamlessly in this gigantic government is hard to imagine.

On a more positive note, with the market near an all-time high – which we just hit last Wednesday – I sense a lot of bearish attitudes coming from investors! From a purely contrarian sentiment perspective, this is a bullish sign. Remember how bullish people were last July, just before the biggest sell-off of 2024? We are far from such bullishness levels now, which is one indicator that is supportive for share prices. A correction can come at any time, but if it were up to sentiment alone, this is not likely to be the Big One.

I’m Worried About the Yen Trade Revival

Last year, the sharpest correction in U.S. stocks happened in July and August, coinciding with something called the unwinding of the yen carry trade. Basically, institutional investors borrowed yen, due to cheap interest rates in Japan – their policy rate is still at 0.5% and their inflation rate is at 4%! – and sold the yen to buy assets with borrowed money, be it stocks, bonds or anything more liquid. When the yen began to move fast against them, they had to sell the assets they bought with borrowed yen to cover their yen shorts, causing a squeeze in the yen (the yen going down means appreciating yen on the chart, as it represents fewer yen per $1), hence the sharp correction in U.S. stocks in late July and early August.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Now, fast forward to late February 2025 and the yen is again appreciating in expectation of another rate hike by the Bank of Japan (BOJ) in about four weeks. I think this persistent rally in the yen is one factor why the U.S. stock market has stalled of late, as these carry trades have short memory. It would not surprise me if some of the same people that got burned last August put the yen trade back on since then.

Last Friday’s 1.7% decline in the S&P 500 is impossible to explain by the economic statistics released that day. The 9:45 am global PMI numbers were a little weak and the 10:00 am inflation expectation numbers were old news, as the preliminary numbers had already moved the market two weeks ago. Since selling started in the first minute of trading and did not stop until the last hour of trading, something else was bothering investors, and one factor unreported by the financial media last Friday could be the yen trade.

The post 2-25-25: The Friday Curse of the S&P 500 appeared first on Navellier.