by Bryan Perry

February 25, 2025

The debate over the use and effects of applying tariffs on imported goods to the U.S. is getting hot and heavy. The long-term impact of tariffs is a complex topic, difficult to sort out properly. On the one hand, tariffs can protect domestic industries and generate revenue for the government. On the other hand, they can disrupt global trade, increase costs for businesses, consumers, and lead to retaliation by several other countries and lead to a trade war. Some vocal critics would have us believe that bringing the global tariff landscape into balance would somehow become an inflationary wrecking ball to the U.S. economy.

Putting tariffs into perspective, as of 2023 – the last full year with complete trade statistics – U.S. exports of goods and services to various countries around the world made up about 11% of our gross domestic product (GDP). That means the vast majority (89%) of the U.S. GDP is generated through domestic activities that include consumer spending, government expenditures, and business investment. And while exports are important, it is our domestic economy that drives almost 90% of our economic growth, and this percentage of exports has range from 9% to 13% since 1990, but the trend has centered around 11%:

Exports of Goods and Services from the United States from 1990 to 2023 (as a % of GDP)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Putting this 11% into dollar terms, consider that the total U.S. GDP for 2024 was approximately $29.2 trillion. Taking 11% of that figure, exports totaled around $3.21 trillion, up 7% from approximately $3.0 trillion in 2023. According to the Congressional Budget Office, the U.S. GDP is projected to be roughly $30 trillion in 2025. With no change in export flow, that implies about $3.3 trillion in U.S. exports.

Source: Macrotrends

To bring more context into this debate, the average tariff the U.S. levies against the world is 2.7%, while the world charges the U.S. 6.7% on average, according to the Observatory of Economic Complexity and the data analytics firm, Datawheel. “On average, the world imposes tariffs more than twice as high as those applied by the U.S. on imports,” said Gilberto Garcia-Vazquez, chief economist at Datawheel.

Now, consider how much the U.S. imports per year. In 2023, the total value of U.S. imports of goods and services was $3.83 trillion. America is the world’s largest importer of goods, and that holds a more meaningful influence over the U.S. economy and lives of everyday Americans than our exports.

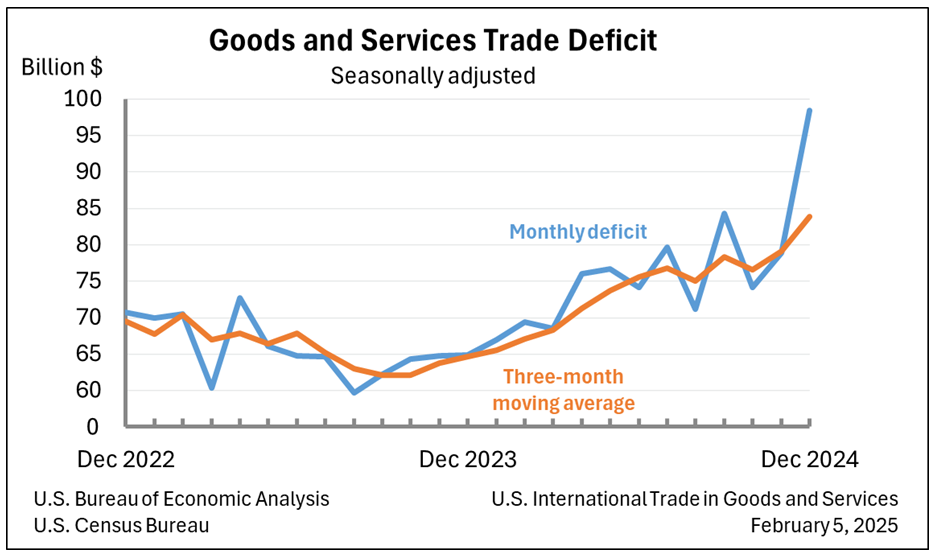

When the 2024 data is finalized, last year will likely top 2023 levels, marking one of the highest import figures observed since 2000. While this high ratio of imports to exports helps keep consumer costs low, there is room to level the tariff playing field to reflect fairer trade and less protectionism from others.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The U.S. trade deficit continued to widen in 2023 and 2024, including in vital industries such as the pharmaceutical supply chain and semiconductors, making us heavily dependent on China and Taiwan, making re-shoring vital for national security, and to narrow the growing trade deficit and dependency on global supply chains that exposed significant vulnerabilities during the Covid-19 pandemic.

Relative to the rest of the world, the U.S. has been a most favored trading partner. The European Union imposes various tariffs on U.S. imports that include a 10% tariff on automobiles, 10% to 25% on agricultural products, and 5% to 20% on consumer goods (electronics, clothing, footwear, etc.). In response, President Trump recently announced 25% tariffs on EU steel and aluminum to take effect on March 12. In anticipation, the EU Commissioner for the Economy said that Europe would respond proportionately to any US tariffs, indicating a readiness to defend its economic interests. Tariffing U.S. goods to the tune of 5% of 25%, one can argue the EU, has long been defending its interests.

The post 2-25-25: Taking Stock of Trump’s Tough Tariff Talk appeared first on Navellier.