by Gary Alexander

February 25, 2025

February 25th, 2025 has a certain symmetry in the way the numbers fall on the page. My-oh my, how true that is!

How is it possible that a single calendar date marks the birth of seven or more singular events in U.S. history – many of them tied to current debates, helping us view today’s hot news trends in wider context.

Maybe Buddy Holly honored this date best, when on February 25, 1957, he and his Crickets drove 100 miles from Lubbock, to Clovis, New Mexico, to record their first (and only #1) hit, “That’ll Be the Day!”

February 25 marks the first Fed, the first cabinet meeting, the first NYSE expansion, our first fiat currency, first big market bubble, first billion-dollar firm and first income tax – all falling on Day #56 of the year.

1. February 25, 1791 – The Birth of the First Bank of the United States

The first of our failed Central Banks – the First Bank of the United States – was the brainchild of our first Secretary of the Treasury, Alexander Hamilton. It was chartered by the young U.S. Congress on February 25, 1791. It lasted only 20 years. It followed the “Bank of North America,” our first de facto national bank, but neither was anything like a modern central bank. They were “national” only in that they could open branches in each state and lend money to the U.S. government. All other banks could only do business in a single state. The First Bank building, in Philadelphia, wasn’t completed until 1797.

Hamilton used the charter of the Bank of England (founded in 1694) as his basis for this First U.S. Bank. He argued that this “Bank of America” could issue any new U.S. currency, provide a safe place to keep public funds, facilitate commercial transactions, collect taxes and pay off the nation’s debts. Virginia’s Thomas Jefferson, of course, disagreed, fearing that a national bank would create a financial monopoly favoring urban financiers and merchants, who tended to be creditors, over plantation owners and farmers.

The Bank’s 20-year charter turned out to be its death sentence, as its charter was not renewed in 1811, even though branches quickly sprang up in Baltimore, Boston, Charleston and New York in 1792, followed by Norfolk (1800), Savannah (1802), Washington, DC (1802), and New Orleans (1805). A quick survey reveals that these branches were in port cities, as tariffs were a major source of tax revenue.

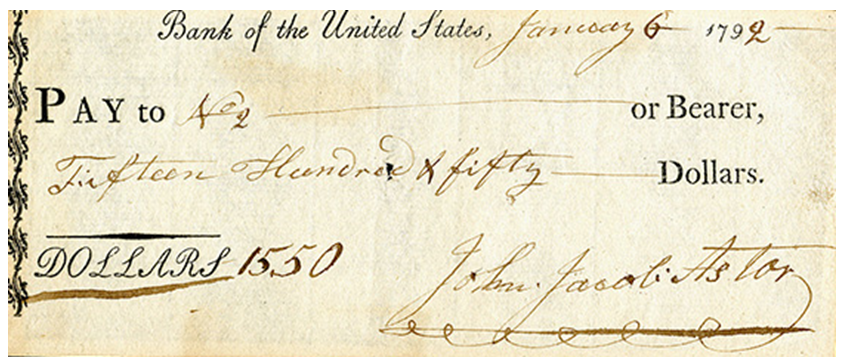

A Bank of the United States check signed by John Jacob Astor in 1792. (Smithsonian via Wikimedia Commons)

In March 1809, outgoing President Jefferson’s Secretary of the Treasury Albert Gallatin recommended renewing the Bank’s charter. Congress let the matter languish until January 1810. At that time, the House gave the renewal request a quick reading but took no action. In January 1811, the House voted against renewal by a single vote. In February 1811, the Senate vote was a tie. Vice president George Clinton (of New York) cast the tie-breaking veto, so the Bank charter renewal was again defeated by a single vote.

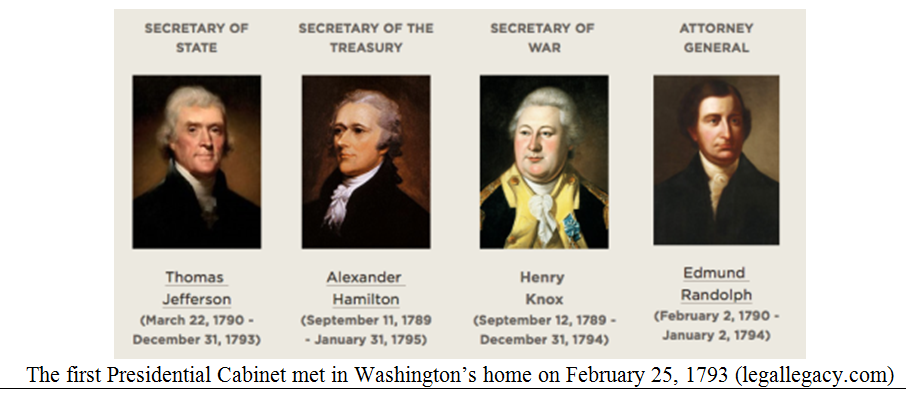

2. February 25, 1793: The First Cabinet Meeting Was Held – at President Washington’s Home

Amazingly enough, 24 of President Trump’s 25 cabinet and close advisory nominations have already been approved 30 days into his “shock and awe” first 100 days, with only his Labor Secretary-designate still being questioned, but it wasn’t until four years into President George Washington’s two terms – about a week before his second inauguration – that he first met with all four of his cabinet team at once, and it was in his home. On February 25, 1793, President Washington held his first cabinet meeting, consisting of Secretary of State Thomas Jefferson, Treasury Secretary Alexander Hamilton, Secretary of War Henry Knox, and Attorney General Edmund Randolph. There were frequent fights between some of them – notably Jefferson and Hamilton – so the peace-making general didn’t often pit them all together.

Jefferson himself said that confronting Hamilton in any intimate cabinet setting was “like two fighting cocks.” From their major political differences arose the foundation for the eventual creation of our two warring political factions (Adams vs. Jefferson) in 1796 – and partisanship ever since. Washington hated conflicts, often writing letters to his two “fighting cocks,” saying this to Hamilton: “My earnest wish is that balsam may be poured into all the wounds which have been given, to prevent them from gangrening.”

3. February 25, 1817: The New York Stock Exchange (NYSE) Board Was First Organized

In early February 1817, when the Erie Canal needed capitalization, several leading Wall Street brokers sent William Lamb to Philadelphia to find out how the Philadelphia Stock Exchange worked so well. On his return, the brokers met in the office of Samuel Beebe to draw up a constitution on February 25th that was nearly identical to that of the Philadelphia Stock Exchange. It was signed by 28 brokers from seven firms, who became the original Board of Brokers of the New York Stock & Exchange Board.

A previous form of the New York stock exchange was founded almost exactly 25 years earlier, under a Buttonwood tree on Wall Street, hence called the Buttonwood Agreement, but that was more or less a cabal to limit trading to those elite. In March 1792, 24 of New York’s leading merchants met secretly at Corre’s Hotel to discuss ways to bring order to the securities business by limiting trade to their cartel. In 1817, New York stockbrokers instituted reforms to broaden their outreach to several locations instead of limiting all their trades to their “Old Boys’ Club” at the Tontine Coffee House, as the boom times began.

4. Fiat Money Creation (1) On February 25, 1862, The U.S. formed the Bureau of Engraving & Printing, and (2) on February 25, 1863, Congress created the National Currency Bureau.

Here are two acts of Congress falling on this date during the Civil War, each facilitating military spending with President Lincoln’s un-backed Greenbacks. Here’s some of the legalese from the National Archives:

“A Congressional act of February 25, 1862 (12 Stat. 346) required engraved signatures and an imprinted Treasury seal on all notes, with such engraving to be done at the Treasury Department, using government personnel and equipment. Under the latter authority, an experimental engraving and printing operation was established in the Treasury Department, from which the personnel and equipment were drawn to organize the First Division of the National Currency Bureau, established by the National Banking Act (12 Stat. 665), February 25, 1863. The First Division, responsible for engraving and printing federally backed bank notes, and known informally as the Bureau of Engraving and Printing as early as 1866, was formally separated from the National Currency Bureau by administrative order in 1869.”

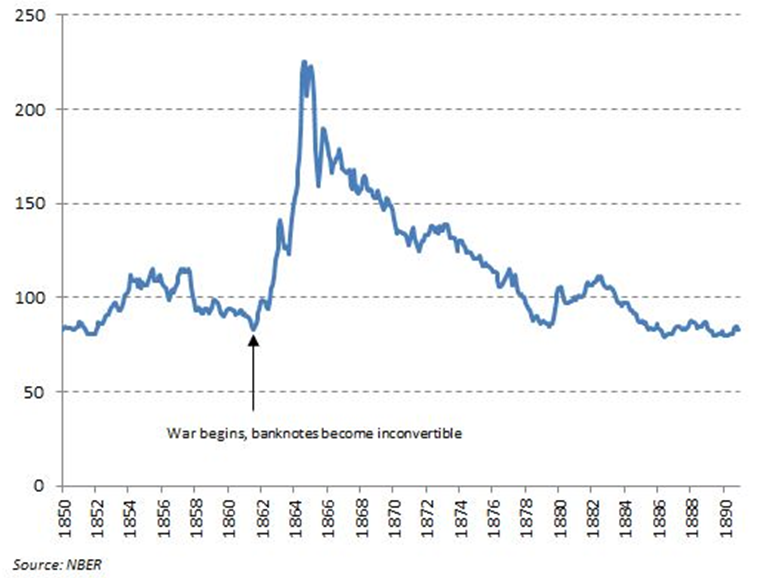

What this means is that prices began soaring when all gold backing was “temporarily” abandoned. Prices in Union states rose about 120% from 1862 to 1866. (Gold and silver backing was resumed in 1879).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Inflation was far worse in the confederate states. Their version of a Consumer Price Index reached hyperinflation with price increases exceeding 9,000%, due to excessive printing of fiat money.

5. On February 25, 1893, the Philadelphia & Reading Railroad bankruptcy launched a Panic

The Panic of 1893 was a long time coming, but it began on this specific date, when the first of the big railroads collapsed. The Philadelphia & Reading railroad listed debts exceeding $125 million on this date, a huge sum for that time. This admission launched the Panic of 1893, which basically lasted four years – the entirety of poor Grover Cleveland’s second term. He’s the only other President (besides Trump) to win two non-consecutive elections. He was also the only Democrat elected after Lincoln (1865) until Woodrow Wilson in 1912. Basically, retired Republican Union Army officers born in Ohio (Grant, Hayes, Garfield, Harrison, McKinley, then Taft) dominated the presidency nine of 11 terms, from 1868 to 1912.

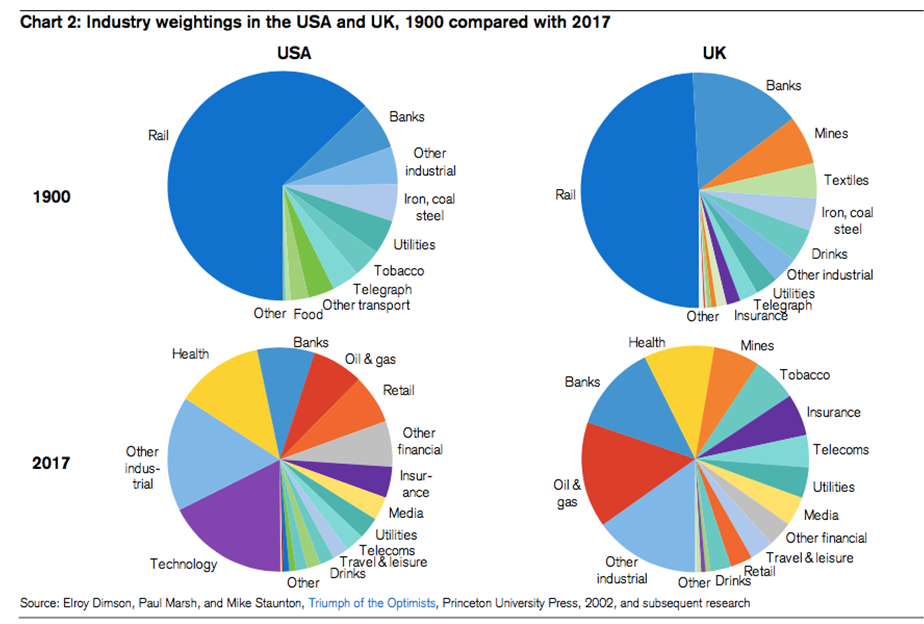

Railroads peaked as a controlling industry in the 1880s, but they still controlled 2/3 of the stock market in the 1890s, controlling far more capital than tech stocks, or any other industry, in recent market decades:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Investors in the 1880s dove into railroad stocks like day traders in 1999 poured cash into dot-com dreams. The bubble burst about a week before Grover Cleveland’s second inauguration, just after the appointment of receivers for the Philadelphia & Reading RR. After P&R failed, a series of banks failed, followed by the Northern Pacific, the Union Pacific and that noted song train, “The Atchison, Topeka and Santa Fe.”

According to estimates back then, about 18% of the workforce was unemployed in the following year.

6. February 25, 1901: J.P. Morgan Created the First Billion-Dollar Company, U.S. Steel

The Industrial Revolution was soaring again at the turn of the century. In 1900 the demand for steel was at peak levels, and J.P. Morgan wanted to dominate this market by creating a centralized combine, or trust, in steel. He heard that Andrew Carnegie wanted to retire, and President William McKinley was warm to business consolidations, so in December 1900, Morgan attended a now-famous dinner at New York’s University Club, where Carnegie Steel’s CEO, Charles Schwab, gave a speech that triggered Morgan’s plan to merge Carnegie and Morgan steel, along with several smaller steel, mining, and shipping firms.

On February 25, 1901, United States Steel Corporation was incorporated with a capitalization of $1.4 billion, the first billion-dollar corporation in history. The 10 companies that were merged to form U.S. Steel were American Bridge Company, American Sheet Steel Company, American Steel Hoop Company, American Steel & Wire Company, American Tin Plate Company, Carnegie Steel Company, Federal Steel Company, Lake Superior Consolidated Iron Mines, National Steel Company and National Tube Company. J.P. Morgan named Schwab the CEO, but the real power was Morgan’s hand-picked deputy, Elbert Gary.

7. February 25, 1913: The 16th Amendment Authorized the First Federal Income Tax

Finally, we come to the hated income tax. In our nation’s first 125 years, including the Age of Invention and our massive and powerful Industrial Revolution, the nation’s main federal fuel came from tariffs.

A federal income tax was beaten down twice by the Supreme Court in the late 1800s, but the 1-2 punch of the Panic of 1893 and Panic of 1907 convinced J.P. Morgan and other financiers that they could no longer stem Panics (what we later called Depressions) by gathering together major bankers to restore investor confidence by throwing money (or gold) back into the market the next morning. They needed: (1) a central bank as our “lender of last resort” and (2) a national income tax system to bring in more tax revenues.

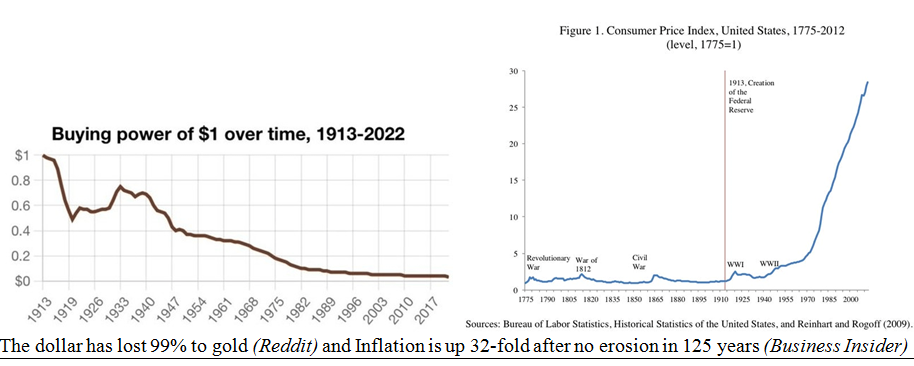

Both came about in 1913, a year that created our modern centralized financial system in the United States, but since then the dollar has lost over 99% to gold and 97% of its purchasing power (32-fold inflation).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This brings us back to the current Trump Revolution, whereby he promises to do away with income tax – or at least remove a great amount of our income from taxation – by funding more federal spending from tariffs. This seems to be an outlandish promise. I give it a 1% chance of materializing, but this 7-part historical survey of our U.S. financial history on a single date, February 25th, can at least give us some hope that we might learn some lessons about 2025 if we dare read some history books from time to time.

The post 2-25-25: All Hail February 25th – a Red-Letter Day in U.S. Financial History appeared first on Navellier.