by Ivan Martchev

February 11, 2025

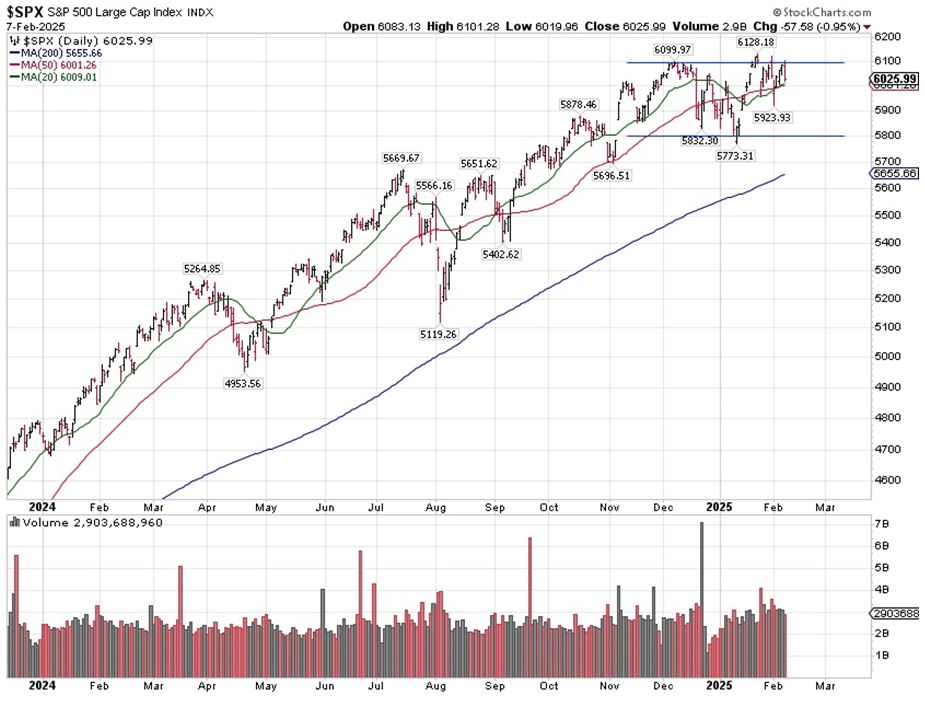

It does not happen very often that one week of trading in the S&P 500 looks like a carbon copy of the previous week, and yet this is what we just experienced. (I am updating the chart that I posted here in last week’s commentary.) I am starting to feel like Bill Murray in Groundhog Day, who plays a “cynical TV weatherman Phil, forced to relive the same day over and over again while reporting on the annual Groundhog Day festivities in Punxsutawney, Pennsylvania. Initially, Phil uses his knowledge of future events for personal gain, but eventually, he learns to use his time to become a better person and win the heart of his producer, Rita” (played by Andie McDowell). – Film summary generated by Google Gemini.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

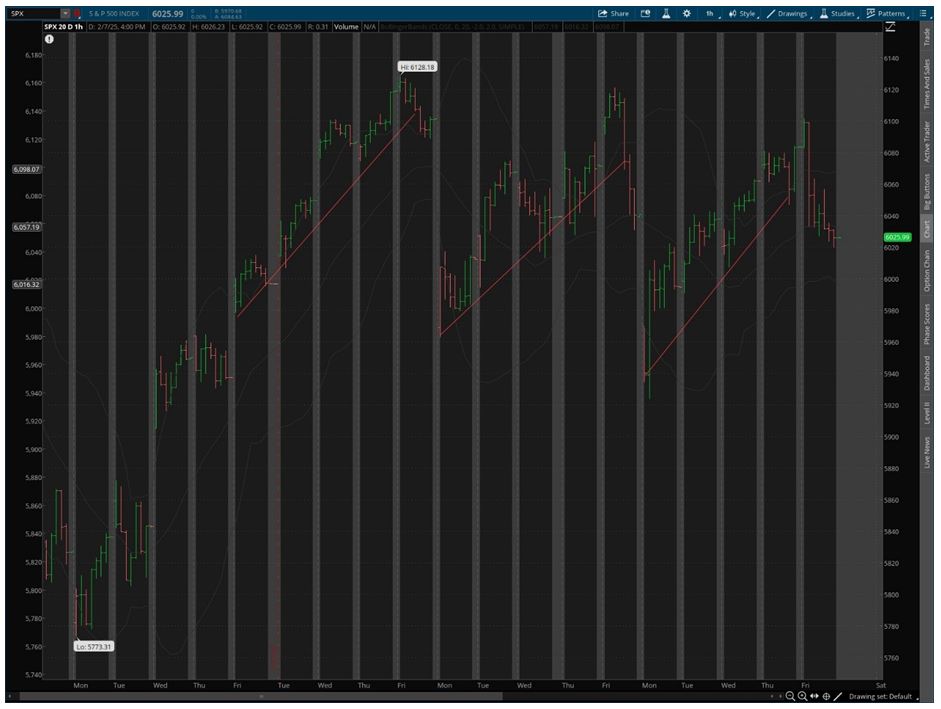

Every Friday (three) of the new Trump administration has ended with a weak close and a substantial drop at the open on Monday (twice). Since I am writing this over the weekend, I don’t know what the third opening on Monday (February 10) will look like, as this volatility is mostly news driven. First, it was DeepSeek (Monday, January 27), then tariffs (Monday, February 3), then last Friday was fear of more tariffs, this time the reciprocal kind. You can see this unusual pattern better on an S&P 500 hourly chart:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

We have relived the same week at least twice, and if we add the first full week of the Trump Presidency (even though technically he is short by half a day, as his term started at noon on January 20), we have seen this pattern repeat itself three times (red lines, above). This type of trading is very unusual, clearly driven by the aggressive policy actions of the new administration and the counter measures they induce.

All this does not mean we have to repeat for a fourth week, as all this drama can reverse itself if we see good news on the trade side, like a truce with China similar to those with Canada and Mexico, or some type of positive development in Ukraine. Obviously, more market shocks may mean more weakness. As things stand now, it is impossible to say which way the market will break. We have had two marginal down weeks in a row in the S&P 500, and we have not had three down weeks since August of last year.

Europe is the Exact Opposite of the U.S. in 2025

The Trump victory in November was met with a surge in U.S. markets and clear selling into strength in most European markets, most notably Germany. Fast forward to January 2025 and we see a mirror image. The U.S. market is in a trading range while Germany’s DAX has bolted out of the gates – up 10% in 2025.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Why such dramatic out-performance? Ironically, the German DAX index is outperforming now for the same reason it under-performed after the Trump election victory. But, In November Trump meant tariffs while now he represents peace. The stock market senses an end to the war in Ukraine.

The U.S. is already cutting funding for Ukraine and Secretary of State Marco Rubio has already stated that the U.S. is financing a protracted stalemate. Simply put, this potential end to the Ukraine war means that Europeans will seek to normalize relations with Russia over the medium term and remove the risk of further escalation outside of Ukrainian borders – and I don’t mean Ukraine’s small incursion into Russia.

I do not believe that things will go back to the way they were before the war in Europe began, and most likely Ukraine will lose most of what the Russians have already captured, but it struck me as self-defeating for the EU to become the biggest buyer of Russian LNG after their access to Russian pipeline gas was mysteriously cut off. From a pure cost-benefit analysis, substituting pipeline gas for multiple-times-more-expensive LNG gas from the same source is not a bright move.

The post 2-11-25: Will We See Another “Groundhog” Week? appeared first on Navellier.