by Jason Bodner

February 11, 2025

Remember the tech crash of 2025? The one where Nvidia (I own personally and in managed accounts) fell almost 17% in a day? It was the largest single-day loss of value in a public company in history.

Now it is like a distant memory. The threat of DeepSeek levelling the AI industry may be real or bunk. We don’t know yet. But the price action we witnessed was classic Wall Street: “Shoot, Ready, Aim!”

Last week, I said DeepSeek’s timing seemed sinister. It is possible that this was an orchestrated bear raid on a crowded “long” trade in U.S. AI-related tech. Either way, it’s in the rear-view mirror for now. NVDA has already staged a 15% rebound from last Monday’s low to last Friday’s high, and is still best-in-show.

Measuring a stock by its best or worst days – both being atypical – is an example of “recency bias.”

Another example of “recency bias,” from years ago, was the Ebola scare. It grabbed world attention, then promptly vanished. The same happened with Zika, the Swine Flu, and other bugs. Each was a big scare for a moment, then disappeared. That’s because information is instantaneous, and our reaction to that “instant” of breaking news gets faster and shorter. Investors were rattled on Monday January 27th as tech shares went into free fall. Now, however, much confidence has returned. But these emotional responses reinforce the need to deal with quantifiable data. What looked like a disaster was a buying opportunity.

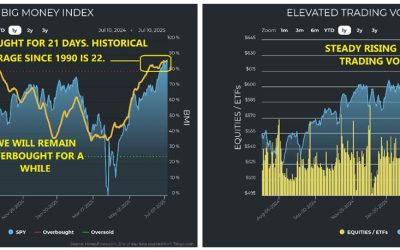

This conclusion comes clear in the data. First, let’s look at the Big Money Index (BMI). As a reminder, this is a 20-Day Moving Average of unusually large money flows. When the BMI rises, buyers are in control; when falling, it is the sellers. As this chart shows, that late-January tech disruption caused a blip on the BMI – but only a “blip,” which rapidly bounced back and now looks set to resume its uptrend:

The post 2-11-25: Don’t Fall Victim to “Recency Bias” (Take a History Pill) appeared first on Navellier.