by Ivan Martchev

February 4, 2025

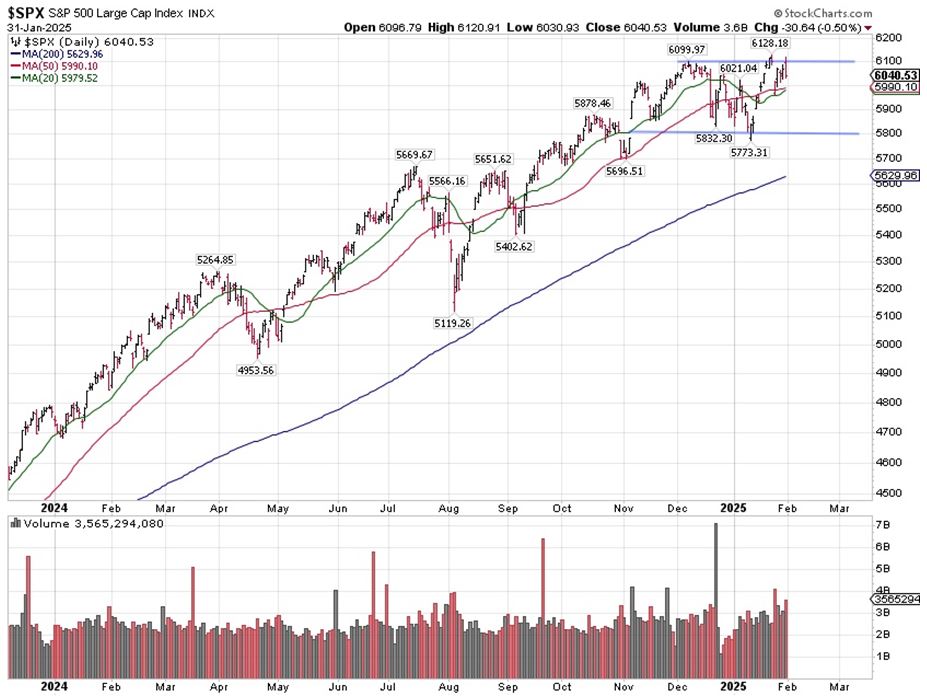

January was a good month for U.S. stocks, with the S&P 500 rising 2.7%, even after the index closed more than 1% off Friday’s intra-day highs, after the Trump administration announced 25% tariffs on most goods from Canada and Mexico and 10% on most goods from China. The Canadians have already announced countermeasures while the Mexicans have not yet done so.

Looking at January as a whole, we had a decisive down week in the first full week of trading followed by two very strong up weeks and a final week that saw a lot of cross currents from Chinese AI would-be disrupters like DeepSeek, followed yet again by FOMC statement’s confusing language as well as those dramatic tariff developments. We can hope the old saw “as goes January, so goes the year” works in 2025.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In the very near term, we have negative seasonality to deal with in February. Over the long term, February and September tend to be bad months, but last February was pretty good and so was September, despite starting the month down. In other words, seasonality is just a guideline but not a guarantee.

That said, we have a trading range developing on the S&P 500, from a few points above 6100 to a few points below 5800. We could touch 5800 again in February, which could be the result of too many tariffs being put on too fast, and too many recipients of such tariffs retaliating. So far, based on present developments, it is impossible to speculate how long this “tit for tat” tariff situation lasts.

Clearly, the problem with illegal immigration and drug trafficking is hundreds times worse when it comes to Mexico, so I expect the Mexicans to move more expeditiously on complying with Trump’s requests. How fast the tariffs are lifted is probably directly contingent on what the Mexicans do to curb drug and human trafficking, which is the second biggest business for the Mexican drug cartels.

There should be some dramatic developments on both fronts by mid-2025, as statistically speaking there has been a dramatic fall in migrant encounters by U.S. border patrol since President Trump took office, with numbers showing declines in the 60% to 90% range, depending on the exact period considered.

We have very important midterm elections less than two years from now, and if the Trump administration can show dramatic falls in the flow of illegal drugs, illegal migrants and other metrics connected with those two serious issues, it will be a major advantage come November 2026.

Unfortunately, because of his abrasive approach aimed at getting results, Trump is likely to cause higher volatility in both stocks and bonds in 2025. That means volatility both up and down. For example, counter tariffs are a negative for stocks but trade deals, when completed, are a big positive. Ending major wars like the one in Ukraine is a big positive, particularly for European equities, while the outbreak of new ones– here Taiwan does come to mind – are a big negative.

The Deepseek Situation is Far from Kosher

Last week started with a sell-off because Chinese firm DeepSeek managed to produce a competitive large language model (LLM) for $6 million, a fraction of what OpenAI spends on its models and without access to the most advanced AI GPU chips. As the week progressed, the tech sector began to recover as many expressed serious concerns that the Chinese had smuggled advanced chips into China, evading export controls, and that DeepSeek was heavily borrowing on all open-sourced LLMs available using a technique called “distillation,” which basically means improving on top of existing progress.

Those existing LLMs cost multiples of $6 million to develop. I don’t believe for a minute that DeepSeek’s product cost $6 million and that will slow spending on AI infrastructure and data centers. We will know more soon, particularly after a famous maker of AI GPU processors reports earnings on February 26.

There was a massive amount of short selling in January as the data made the front pages of major news outlets (like the The Telegraph’s January 31 article, “Hedge funds bet billions on market crash in Trump’s America”). If the tariff situation does not develop according to a worst-case scenario and it turns out that AI chip demand is still robust, the market may be prone to a short squeeze and new highs by February 28.

The post 2-4-25: The Cycle of Tariff Recriminations Has Started appeared first on Navellier.