by Ivan Martchev

January 28, 2025

After the latest rally, we may see the old saw (“as goes January so goes the year”) play out in 2025. What we have seen so far is the month of January starting out choppy, with a down week in the first full week of trading and then a sharp rally to fresh all-time highs in the following two weeks.

That would not be a bad road map for 2025, if history decides to rhyme with the January Barometer.

Still, we just saw the fastest rise in Treasury yields after a Federal Reserve rate cutting cycle beginning (last September) because of high deficits, followed by the unorthodox fiscal policies of the new Trump administration. If we see the 10-year Treasury yield move above 4.80%, the stock market would not like the results, and the stock market may get really worried if we see the 10-year above 5%. This is not my base case scenario, but we have to keep in mind that inflation is seasonally strong in the first quarter and in 2024 the January inflation report (that came out in February) was quite the shock for the stock market.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Companies tend to raise prices in January and in the first quarter of the year – and we need to remember that in the next three months. If we don’t get an inflation spike and Treasury yields begin to trend below 4.50%, then the stock market will focus more on trade and fiscal issues, as opposed to interest rates.

We also need to remember that seasonality is not a promise. December was supposed to be strong, but it turned out to be weak. Since 1928, September is the weakest seasonal month, but last year only the first week was down while the rest of the month was strong, so as we approach February (which is weak over the long term), we must remember that seasonality is a guideline, but it can deviate widely each year.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Possible Positive Catalysts from Geopolitics

It is widely expected that the Trump administration will seriously engage with Russia and Ukraine to end that war. There is a clear stick and carrot approach, as the Trump administration is already halting some aid to Ukraine. The Russians, though, are not big connoisseurs of the stick approach, as sanctions have done nothing to end the fighting so far. I expect to see a deal similar to the Istanbul negotiations from 2022, which Ukraine tentatively agreed to, but then reneged on, as urged by British PM Boris Johnson.

If there is a peace deal similar to the one discussed in Istanbul, but Ukraine loses 20 percent of its territory, it is fair to say that Boris Johnson will have turned out to be one of the most damaging politicians in Ukrainian post-WW2 history, bested only by Vladimir Putin himself.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

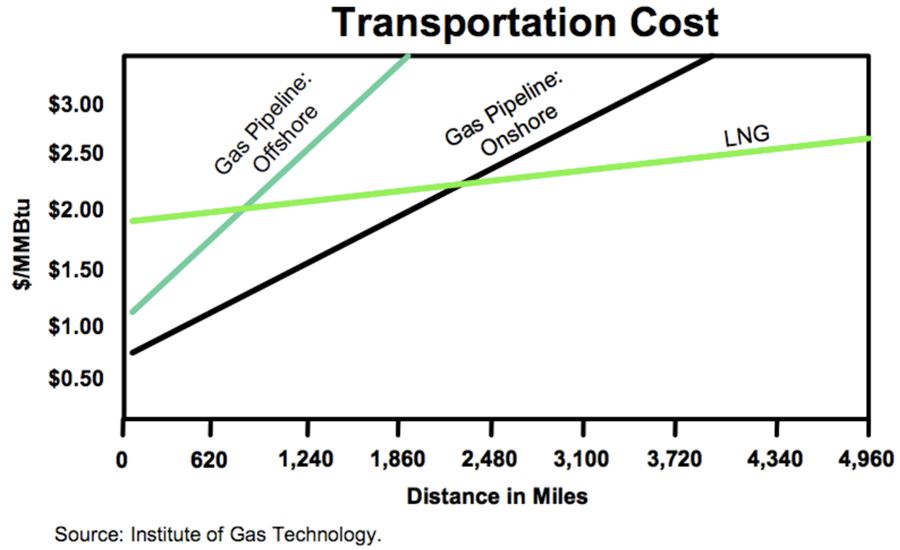

Whoever is to blame, peace will boost the euro and European assets in general. I don’t expect Europeans to flock to Russian pipeline natural gas anytime soon, despite the fact that bombed out pipelines can be repaired. It would not be smart for Europeans to be the biggest buyers of Russian LNG after the disabling of the pipelines, provided that LNG is multiple times more expensive, particularly over shorter distances.

The post 1-28-25: Watch Out for a Return of Seasonal Inflation appeared first on Navellier.