by Bryan Perry

January 28, 2025

With the S&P 500 trading at a new all-time high, and Nasdaq not far behind, investors who are squarely positioned in the leading stocks within technology, travel, financial, communications, and the industrial sectors are enjoying the ride. For the most part, market leadership has been narrow, until lately, when we’ve seen growing evidence that market breadth is improving as lagging sectors begin to participate.

Those seeking new places to allocate capital in areas of the market that are out of favor need look no further than healthcare and consumer staples, but there are a couple of themes that should emerge in the year ahead that could bring about a major change in investor sentiment that I think are worth your attention. We often need to see a big catalyst to lift a lagging sector out of its funk enough to commence a transformation that becomes a new secular trend, and I would suggest a couple are already beginning.

AI-Assisted Biotech Research

One of the areas that does not get nearly enough mention as to the future impact of AI is that of medical research, especially the biotechnology space. As a sector that is generally out of favor with the investment community, many of the leading biotech and bio-pharmaceutical stocks and ETFs have sorely lagged in performance over the past two years. But I believe that is about to change.

For 2025, it is my view that there will be a number of new discoveries accelerated by the augment of AI in the R&D labs – like no other time in history. What used to take years and $100 million (minimum) to develop into novel therapies and newly discovered compounds could take just a few months. This would accelerate Phase 1, Phase 2 and Phase 3 of clinical trials to bring advanced drugs to FDA approval.

Imagine the once-seemingly unreachable cures to Alzheimer’s and Parkinson’s diseases finally seeing robust results that stem the effects of each disease with the potential of possibly reversing these life destroying conditions – or rapid advancements in cancer treatments that have been years in the making.

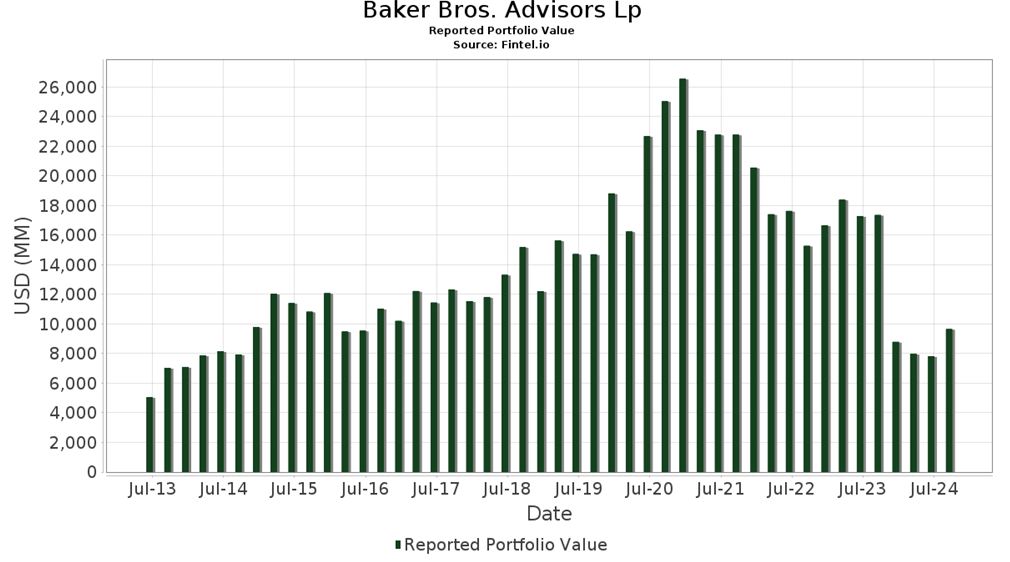

Biotech stocks carry a great deal of risk due to the nature of the business of successful versus failed trials. To this point, I follow the famous bio-technology/bio-pharma specific Baker Bros. Advisors hedge fund run by Julian and Charles Baker and look at their top holdings that are also among the top holdings within the most prominent biotech ETFs. The Baker Brothers’ assets under management topped out in 2020 just north of $26 billion and are currently down 63% to $9.6 billion. Talk about falling out of favor.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

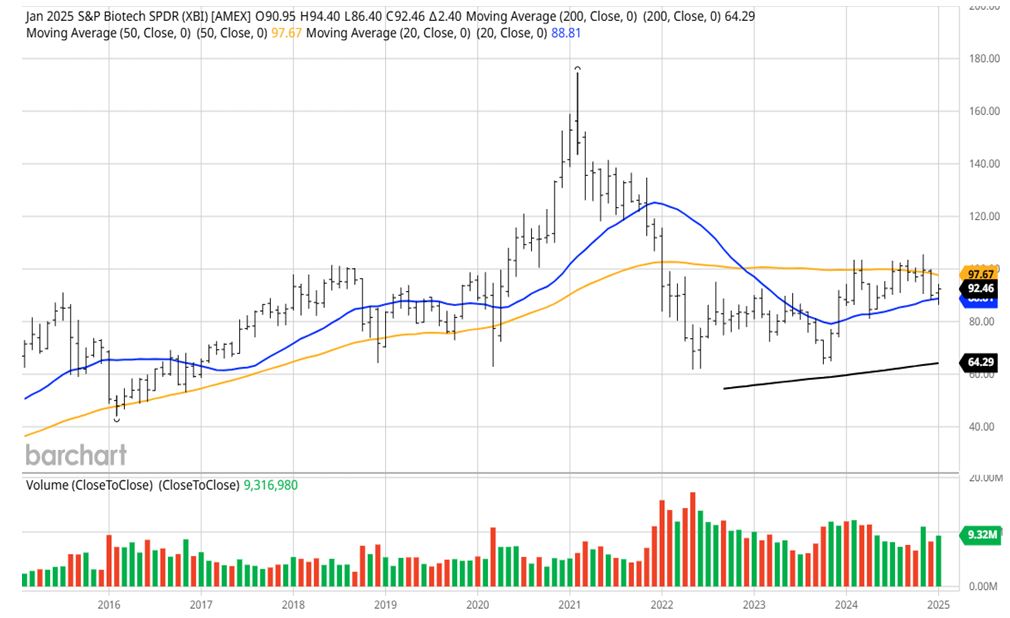

The same can be said for most of the widely traded life sciences ETFs. Following huge outflows of assets in recent years, the first signs of positive fund flows emerged in the past couple of months due to what I believe is the promise of what AI will bring to the drug development industry and the potential of delivering phenomenal shrinkage in the time it takes to bring a new drug from Petrie-dish to the market.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Investors seeking yield and income can utilize some healthcare closed-end funds that have highly attractive yields. The following funds have at least $1 billion in assets:

- BlackRock Health Sciences Term Trust (BMEZ) – Distribution Rate 13.05%

- Abrdn Healthcare Investors (HQH) – Distribution Rate 13.96%

- Abrdn Healthcare Opportunities Fund (THQ) – Distribution Rate 10.58%

Healthier Food Companies

Turning to another out-of-favor market sub-sector – the packaged food and beverage industry – there is a new heart-healthy sheriff in town. With the likely confirmation of Robert F. Kennedy Jr. as Secretary of Health and Human Services this week, his placement in this powerful position will be pivotal to how the food industry will operate. According to Access to Nutrition Foundation (ATNI), around 70% of products sold by the world’s 30 biggest food and beverage companies are unhealthy, and nine are based in the U.S.

Greg Garrett, ATNI executive director, told Newsweek there had been marginal improvements, with 34% of sales coming from healthy foods in 2024, rather than 27% in 2021, “But that’s nowhere near even half,” he said. “If we’re going to get to 50% by 2030, things have to move much faster. It’s still a bleak picture. And … not one of these companies is willing to stop marketing those unhealthy products to children.”

The refined foods and package foods industry that promotes sugar, salt, saturated fat, artificial flavors, artificial colors, additives and preservatives has dominated the regulatory challenge at the Food and Drug Administration for decades. Roughly 35% of Americans are obese, the highest in our nation’s history, leading to cardiac disease, hypertension and a host of related illnesses and debilitating life-threating conditions.

This could all start to change in 2025 as RFK Jr. and his upper management team usher in new standards and mandates on the big food conglomerates, all in order to promote much healthier products, holding companies accountable under new laws and sweeping regulations that will trigger a sea change of how foods and beverages are brought to the marketplace. This wave of change is overdue, but it takes someone like RFK Jr. and others to heighten consumer awareness and take a wrecking ball to the powerful food and beverage special interest groups and lobbies that have had grip on America’s food industry.

Most of the big consumer staples stocks are trading at or near multi-year lows as the S&P 500 trades at new all-time highs. There has to be enormous pressure on the boards and c-suites from the largest institutional shareholders of these companies to forge a strategy to greatly improve shareholder value. That will only come with the launch of new, healthier products. The biggest companies with multiple bad-for-you brands will have to make wholesale changes or continue to see the value of their stocks crumble.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

To this end, I believe that they will do what every public company has to do – pay attention to the bottom line and the price of their stock. Of these major food and beverage companies that stand to make the greatest changes, the worst offenders have the most to gain from making sweeping changes. And at current price levels, several of these stocks pay dividend yields of between 3.5% and 5.5%.

The post 1-28-25: AI and RFK Jr. are Breathing New Life into Two Lagging Sectors appeared first on Navellier.