by Jason Bodner

January 14, 2025

It’s time for the January Effect – a little overtime, in fact. The January Effect is the theory that stock prices rise more in January than in other months. That would be a lovely outcome, but so far 2025 is not working out as expected. Los Angeles is dealing with catastrophic fires, with thousands of families losing their homes, while both the North and the South are in deep freeze. There’s a beef between the U.S. and Canada – and maybe Greenland, Panama, Mexico and other nations, too – and Nvidia’s CEO Jensen Huang splashed cold water on quantum computing stocks, sending them off a cliff. As I write this, all four major stock indexes are in the red for the year-to-date, so what gives? Where’s that “January effect”?

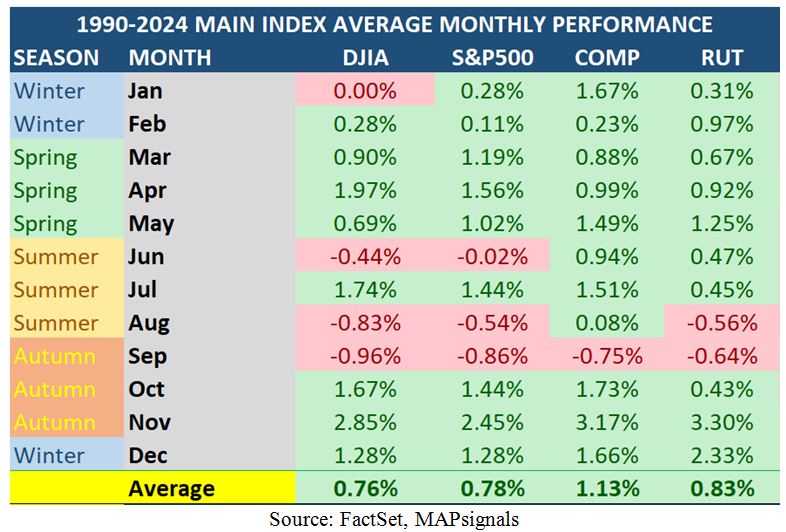

First things first. Let’s look at the major stock market indexes going back to 1990: Only 20 of 35 Januarys (57%) since then showed positive returns for the S&P 500 – just four out of seven. Compare that to November, which was positive 74% of the time. Perhaps the January effect isn’t really something to rely on. As we can see below, January is flat in the Dow, and only up 0.3% in the S&P and Russell 2000. The only sign of life among the four major indexes is in the NASDAQ Composite (averaging +1.67%):

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The post 1-14-25: It’s Almost Mid-January – So, Where’s That “January Effect?” appeared first on Navellier.