by Gary Alexander

December 17, 2024

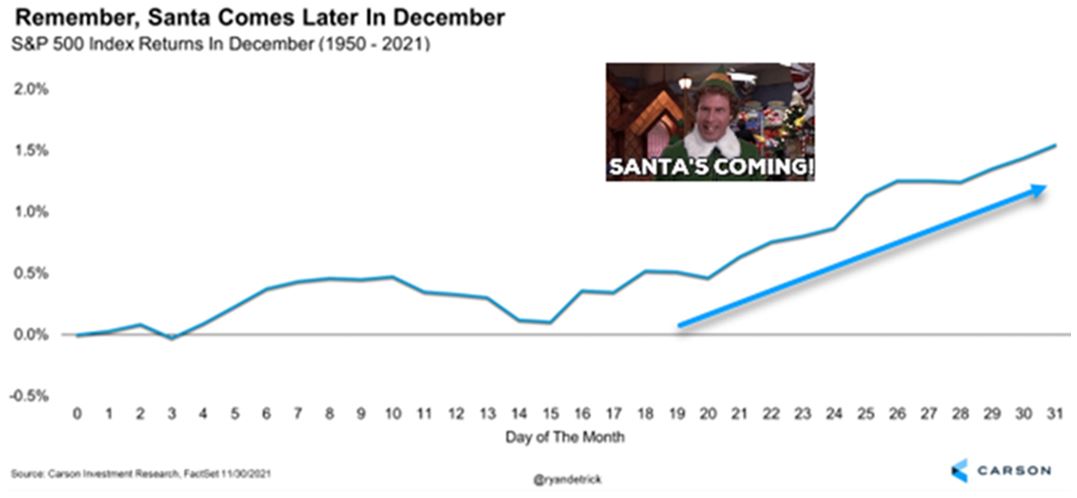

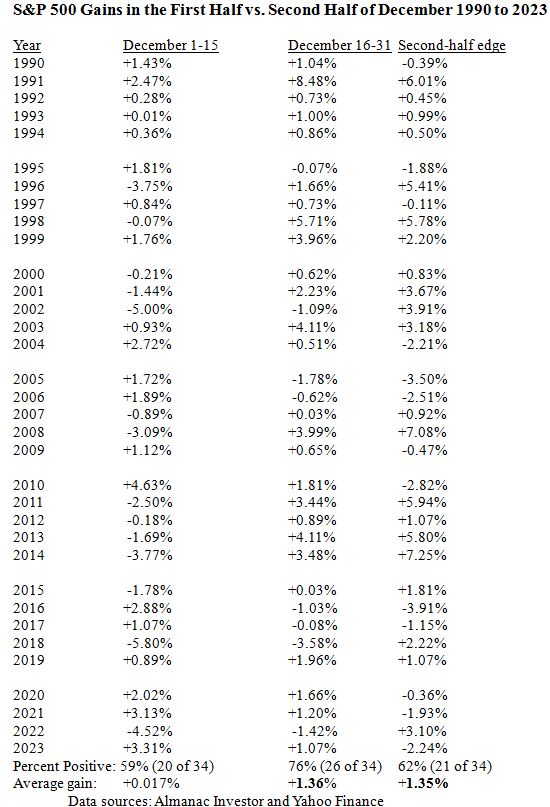

The second half of December begins now. The 16th is the central day of a 31-day month, marking the start of the annual “Santa Claus Rally.” Below, I’ll chart the S&P 500 for each of the last 34 years, but when I started noticing this trend in the late 1990s, I saw this dramatic trend first in the Dow Jones Industrials:

- In December 1996, the Dow fell 253 points by the 16th, but then it gained back 180 points by year’s end.

- In the second week of December 1997, the Dow fell 319 points, but it gained back 70 points by the 31st.

- In 1998, the Dow lost 480 points in the first two weeks but gained back 485 points by year’s end.

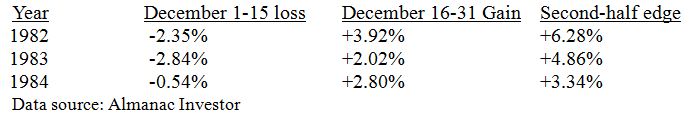

Data source: Almanac Investor

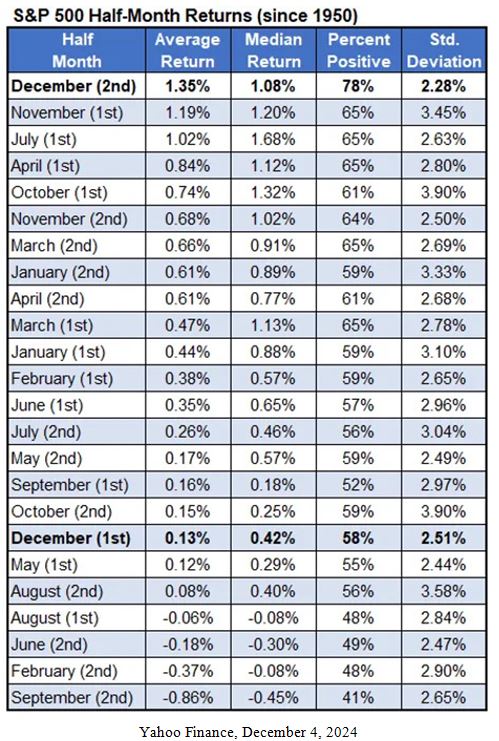

The S&P 500 delivers an average zero gains in the first half of December (and 0.3% through December 15 this year), but averages 1.35% in the second half, the best half-month of the 24 half-months each year.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The first half of December ranks an anemic #18 out of 24 half-months, but the second half of December ranks #1 in highest average return and the top percentage of positive returns – leading by 13% (78% vs. 65% for #2). It also sports the lowest standard deviation of average returns, making today the best day to buy.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

I checked this data for myself, starting in 1982. On December 16, 1982, the Dow closed below 1,000 for the last time, at 990.25. It took over a decade between the first time the Dow closed above 1,000 (on November 21, 1972) and the last time it closed below 1,000, even though inflation soared by 130% in that decade, making the term “1,000 Dow” meaningless a decade later. Then, stocks soared in the next 18 years. On December 17, 1982, the Dow rose 21 points (+2.2%) to 1,011, then soared to 11,500 by 1999.

Santa Claus rallies were clear in those first years, with negative first halves, then positive second halves:

To keep this data stream manageable, I used Jason Bodner’s starting year for his MapSignals calculations for measuring stock market performance. I charted each December since 1990, using the S&P 500, and I came up with the same average as the Yahoo table, above (+1.36% for the second half, December 16-31), and a nearly flat (-0.017%) first half of December for the last 34 years. Go, Santa, Go! Ho, Ho, Ho!

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Merry Christmas, Happy New Year and Profitable Stock Selection to All (and to all a Good Night!).

Celebrating America’s 250th Birthday – Part II

As described here last week, there was armed action against the British on December 15, 1774, 250 years ago this week, but something much bigger and more famous happened a year previously, although it was not an armed battle in the traditional sense. On the night of December 16, 1773, a group of Massachusetts colonists disguised themselves as Mohawk Indians (with the implied arms of their sheathed hatchets) and forcefully boarded three British tea ships in Boston harbor, dumping 342 chests of tea into the Bay.

This midnight raid was in protest of the British Parliament’s Tea Act of 1773, which granted the East India Company a monopoly on the American tea trade, which allowed them to raise their taxes on tea.

The American Revolution wasn’t really wrapped up in a bow for 18 more years, not until December 15, 1791, with the ratification of the Bill of Rights which added 10 Amendments to the United States Constitution.

On a similar date, December 16, 1689, the English Parliament adopted the first Bill of Rights (based on the writings of John Locke) as part of their Glorious (relatively bloodless) Revolution, 102 years earlier.

Three Famous Mid-December Events in Early American History

When it comes to stock market history, December 16 wasn’t always a day for Santa Claus celebrations on Wall Street. On December 16, 1835, Wall Street’s Exchange Building in lower Manhattan was totally destroyed by fire, leaving the New York Stock Exchange homeless for the entirety of the Panic of 1837.

Over 600 buildings were destroyed, including insurance companies contracted to pay for the fire damage. NYSE didn’t move back into the Exchange Building until 1842. All these losses helped to cause the Panic of 1837. The fire caused $22 million in damages, a figure greater than the national debt at the time, since President Andrew Jackson paid off the national debt (for the one and only time in our history) by the start of 1835, primarily through federal land sales and high tariffs – lessons for today’s politicians, I suppose.

The post 12-17-24: Santa Claus is Coming to Wall Street … Starting This Week? appeared first on Navellier.