by Bryan Perry

December 17, 2024

“Drill baby, drill” has been a rallying cry by the incoming Trump administration, with the goal of driving up energy production and bringing down prices. Trump has endorsed an all-of-the-above energy blueprint that supports fossil fuels and renewable energy sources, including solar, wind, geothermal and nuclear.

The American Petroleum Institute (API) has presented Trump with a list of requests supporting traditional fossil fuel businesses, including many things that the president-elect has promised to do, like rolling back incentives for producing and buying electric vehicles, restarting permitting for liquid natural gas exports, opening up more land for drilling for oil, and repealing or relaxing many environmental regulations.

Regardless of what Mr. Trump wants, the market still dictates production based on supply and demand. Presidents can try to influence the industry, but market forces still dominate companies’ decision-making process. Even under Biden’s restrictive policies, U.S. oil production rose to an all-time high in 2024.

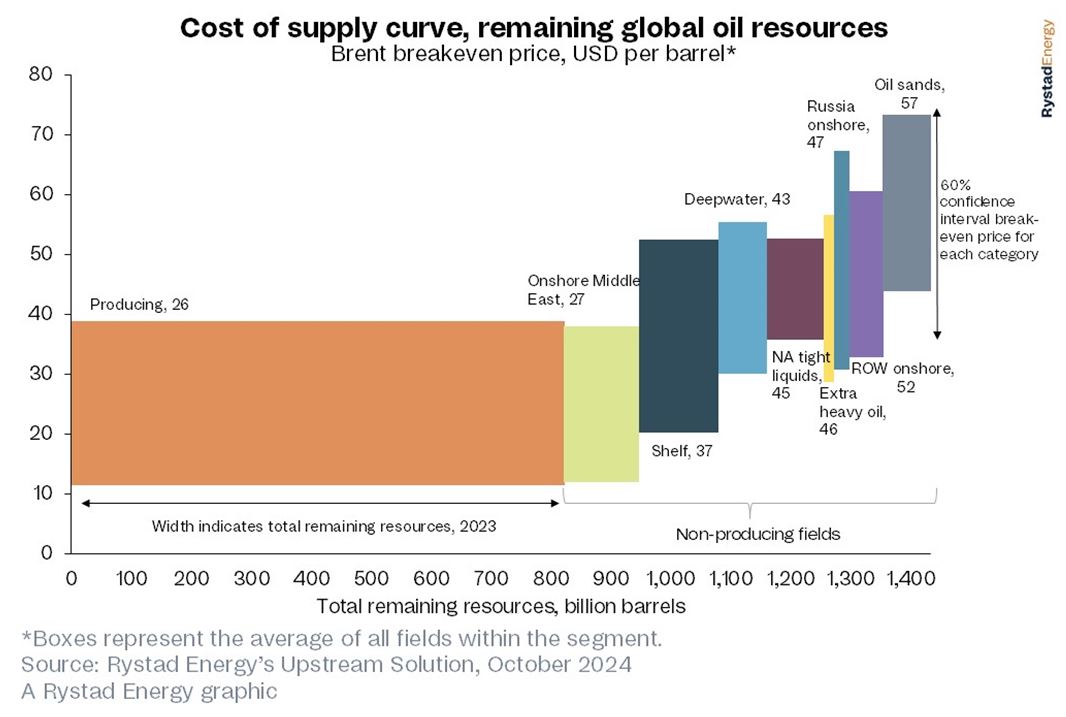

Translation: Oil companies are not going to produce more oil and absorb losses just to drive down prices. The average break-even price of most oil producers varies by region and type of production. Here are some cases in point: (1) In the Permian Basin, the break-even price for new wells is around $62 per barrel, while (2) for existing wells, it’s about $38 per barrel. (3) On a broader scale, the average break-even price for non-OPEC oil producers is about $47 for Brent crude. OPEC has reduced its demand forecasts and has responded to falling prices by delaying planned production increases in an effort to stabilize the market.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

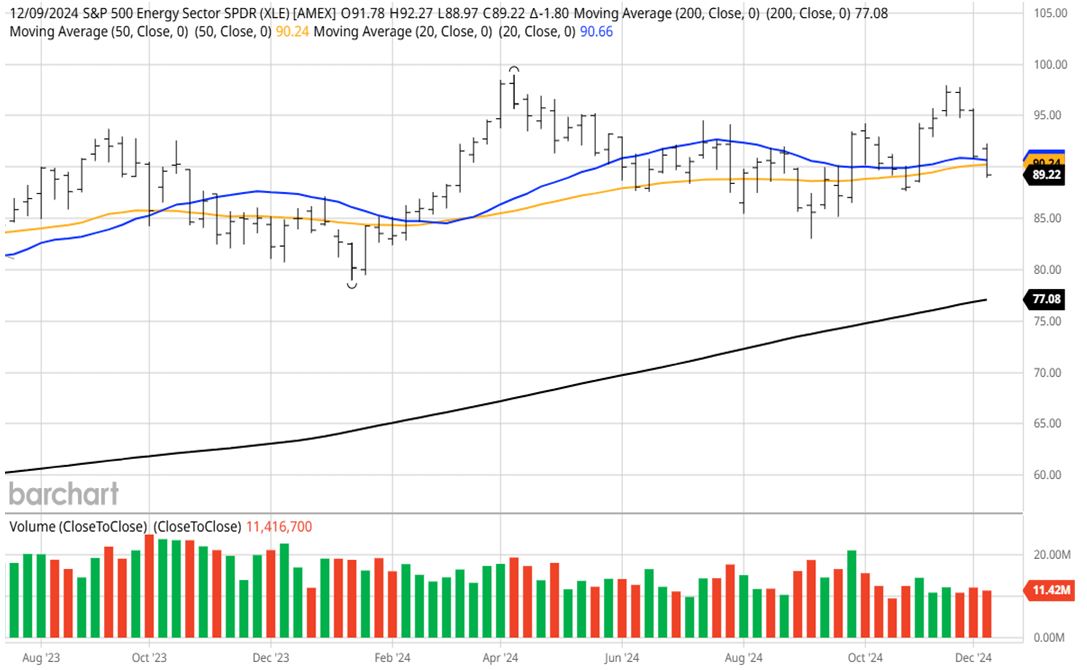

Assuming these break-even price levels don’t shift too much, up or down, over the next four years, it stands to reason that as long as the U.S. can grow its GDP by 2.5% or more, demand for fossil fuels for domestic use will increase. Around the globe, demand has waned, which continues to support the case for the U.S. remaining a uniquely strong economy, now accounting for nearly 30% of global GDP. Year-to-date, the energy sector has gained only about 5% in market value, reflecting this softer global outlook.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

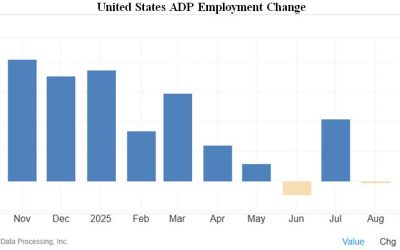

Rather than try to figure out specific winners and losers in the exploration and production side of the energy investment complex – where there appears to be uncertainly about costs and pricing – investors seeking steady returns and high yields from the energy sector need not to look at the energy infrastructure sub-sector that features pipelines, storage and processing of oil and natural gas. Also known as midstream operations, they manage the transport of oil, gas, and liquids from production sites to storage or end users.

Usually, these assets are traded in the form of Master Limited Partnerships (MLPs) and pay high dividend yields, but they also saddle investors with year-end K-1 tax reports that most investors and tax preparers find unfavorable. To resolve this hurdle, some ETFs own the high-yield MLPs and convert K-1 income into 1099 dividend income paid to investors – a hugely attractive feature. Some choices to consider are:

- Alerian MLP ETF (AMLP) – 7.56% Yield

- Global X MLP ETF (MLPA) – 7.11% Yield

- InfraCap MLP ETF (AMZA) – 7.01% Yield

Check them out. In a market where inflation is proving stickier than the Fed wants or anticipates – and will likely slow the pace of future rate cuts – earning 7%+ on inflation-sensitive domestic assets where production is set to increase bodes well for future potential dividend increases and capital appreciation.

The post 12-17-24: Bullish Energy Policies Could Boost High-Yield Oil and Gas Infrastructure appeared first on Navellier.