by Ivan Martchev

December 10, 2024

If my math is correct, starting today (and including a half-day on Christmas Eve), we have just 15 trading days until the end of the year. We have two normal trading weeks and then the week of Christmas and New Year, which are not full trading weeks. Those shortened weeks tend to be positive, although a lot can happen in the next two weeks before the shortened half-day of trading on Christmas Eve.

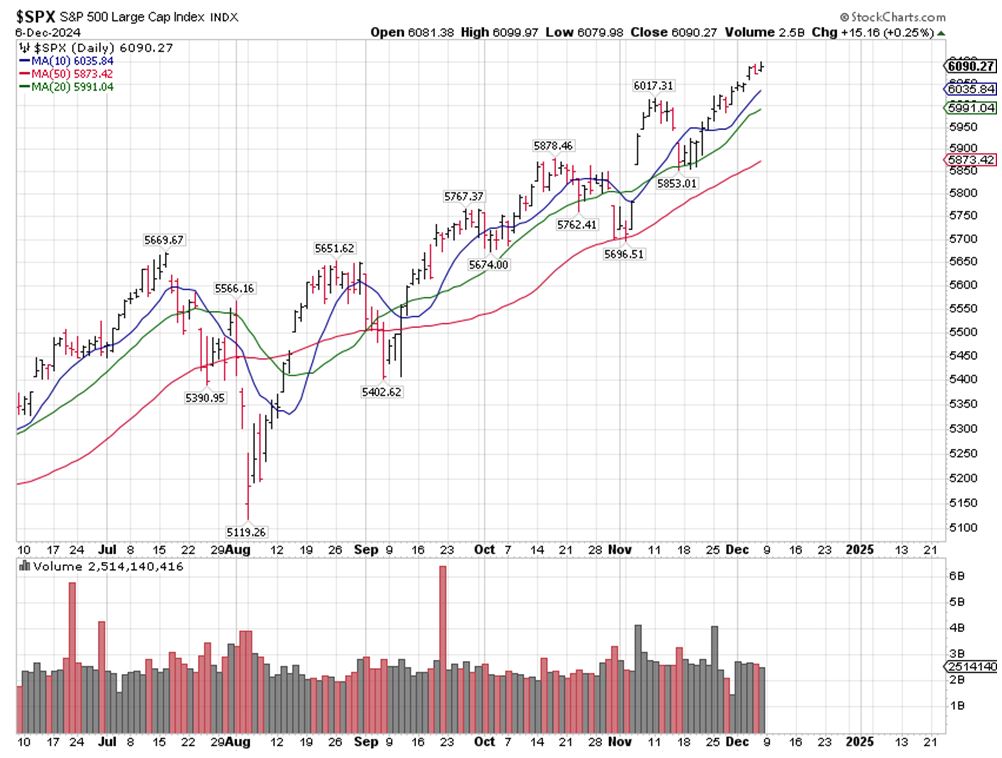

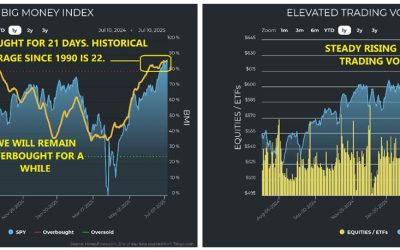

One would think that it would be normal to see a small pullback after the market has risen for three weeks in a row, but this is the home stretch of a very good year, and the stock market may choose to delay any pullback all the way into 2025. Still, no one knows how the inflation numbers this week – the CPI on Wednesday and the PPI on Thursday – will break. If good, we should see more buying (and vice versa).

Last week, I wrote that we can make it to 6300 on the S&P 500 (vs. a close of 6090 last Friday), assuming no negative geopolitical surprises and a further fall in Treasury yields, which were again down last week. Powell should also cut the fed funds rate next week, as that is already priced into fed funds futures.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

It must be noted that over the past week there was some selling into strength on up days, which I suppose would be normal as the S&P 500 made it to within 0.03 of a point below 6100 and a fresh all-time high.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The Russell 2000 small-cap index, the new market leader, which is supposed to benefit disproportionately from falling interest rates and deregulation, hasn’t done much for eight training days (as of Sunday), other than drift lower. This is normal for the Russell, which is an index famous for its violent fits and starts. If the Russell is in a strong rally mode, as it appears to be, it is due to move violently higher this week, and the expectation of good inflation numbers or good numbers themselves would be a good catalyst to do so.

The problem with the small caps, though, is that they are small. The whole of the Russell 2000 index is smaller in market value than one stock alone – Nvidia (NVDA) – so the Russell 2000 cannot pull up the whole market the way the Nasdaq 100 Index can – as that index also made a fresh all-time high on Friday.

When the stock market is at a crossroads and one is not sure which way it will break next, it is often a good idea to keep an eye on the performance of Goldman-Sach’s (GS) stock, as this company is very leveraged to capital markets, along with a smaller wealth management consumer businesses, than some of its competitors. One could even say that Goldman is a stock market indicator in and of itself.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Right now, Goldman’s stock has pulled back into its short-term moving averages and it will most likely head higher this week with deregulation expected to turbocharge capital market activity in 2025.

Obviously, we can’t know in advance what kind of headlines can hit the tape at any moment in time, but looking at the way Goldman’s stock is acting, and considering the outlook for its business, it seems to me that the overall stock market is headed higher – so the glass is half full, and still rising, not half empty.

Navellier & Associates owns Nvidia Corp (NVDA), in managed accounts. We do not own Goldman Sachs (GS). Ivan Martchev does not personally own Nvidia Corp (NVDA), or Goldman Sachs (GS).

The post 12-10-24: The Stock Market Glass Looks Half Full appeared first on Navellier.