by Gary Alexander

December 10, 2024

This Friday, December 13, 2024, marks the first of several 250th birthday parties for America, since organized armies of Americans began fighting for freedom during this week in 1774 (see below). Maybe nobody else noticed, but Paul Revere had a much longer, colder ride to herald the nation’s birth that day.

Back then, there were barely two million Americans fighting the world’s greatest power. We are now a melting pot of about 340 million, and infinitely richer, but where are we headed as we turn 250 next year?

Short-term, one reason to remain bullish on the U.S. economy and stock market is that the U.S. consumer is always poised to rescue whatever ails us, and the flush Baby Boomer generation (born 1946-64) will be ages 61 to 79 next year and sitting on $80 trillion in net worth, or 52% of our $154 in national net worth.

By and large, Boomer mortgages are paid off, their kids are out of college, their 401(k)s are plush, and they are ready to spend on cruises and creature comforts and then pass along the remainder to their heirs.

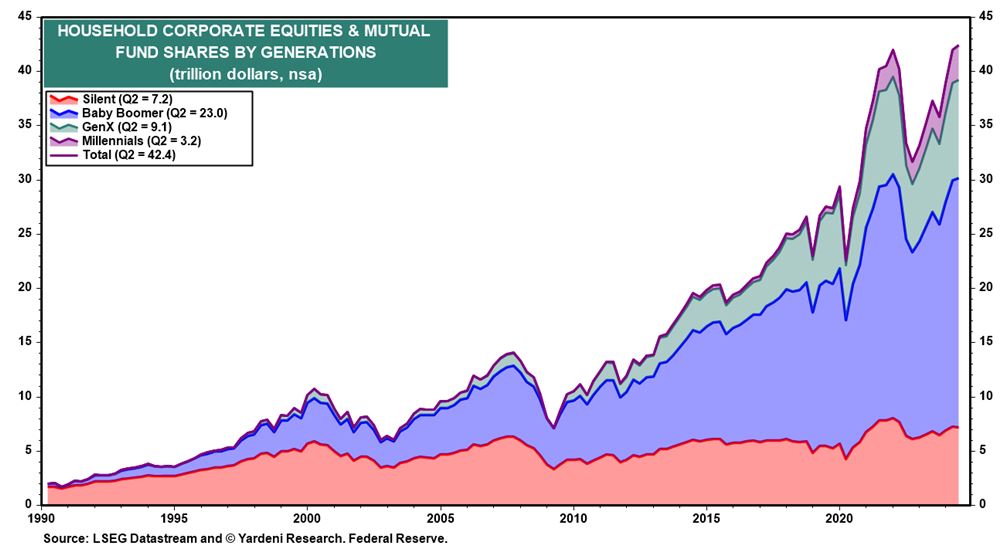

As of June 30, 2024, the Baby Boomers held about half of our net national real estate equity, and almost 55% ($23 trillion out of $42 trillion) in our total holdings of equities (see chart, below), the fastest rising asset class, while the other age cohorts are mostly flat-lining in their percentage of equity exposure.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Baby Boomers also own about 55% of pension assets as of mid-2024, with $9.8 out of $17.6 trillion in assets. As a result, you’re seeing many Boomers now helping their children and grandchildren navigate these very formidable housing, labor and debt markets in a more challenging economic environment.

You may recall that Boomers were the generation that said, “Don’t trust anyone over 30” or “Capitalism is evil,” but that was only the most vocal or violent of their cohorts – many of whom went into academic careers, brainwashing the next generation of students. The vast majority of Boomers work and invest.

If you would like to invest along with the Boomer cohort, consider their spending habits in the years left to them on this planet. Much of their cash will be drained via health and healthcare costs (not by choice, but by the unforgiving toll of aging), but before their final roll call, they will try to cheat the Grim Reaper at restaurants, in entertainment, cruises and travel, plus real estate for second homes or homes for heirs.

The latest (third annual) review of parental help revealed that 47% of parents with grown children provide them with at least some form of financial support, averaging $16,600 per year, or more than double what those working adult children can contribute to their own retirement. These Gen-X and Millennial heirs may love (or endure) their Boomer parents, but they also must rely on their nest eggs.

Make Love (and Children), Not Culture Wars

Bear in mind that I have fought for a lifetime against the Ponzi schemes by FDR and LBJ to put most of the burden of our personal savings for retirement and medical need onto future generations through forced payroll deductions, but we can go to jail resisting this mandate, so we must find more younger workers.

Therefore, our biggest long-term financial challenge is to convince Millennials and younger cohorts that the world is not ending, the climate will not destroy us, we are not lurching into World War III any time soon, and so it’s safe to bring children into this world. Similar challenges faced my wife and me 58 years ago, with the Cold War, worse pollution than now, racial riots, campus unrest, Vietnam, Watergate and (later) disco music, yet we had three children by 1972, now in their 50s, and six grandchildren (five now in their 20s) paying into Medicare and Social Security coffers (thank you, family), funding us and others!

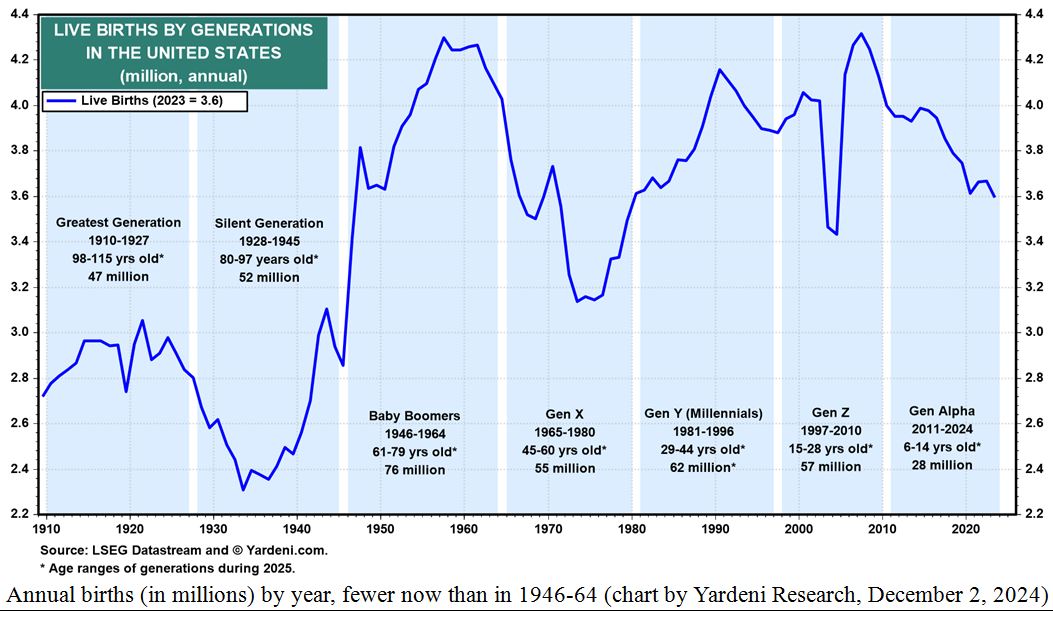

But that isn’t happening enough, as the U.S. birth rate began dipping after the Great Recession of 2008:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

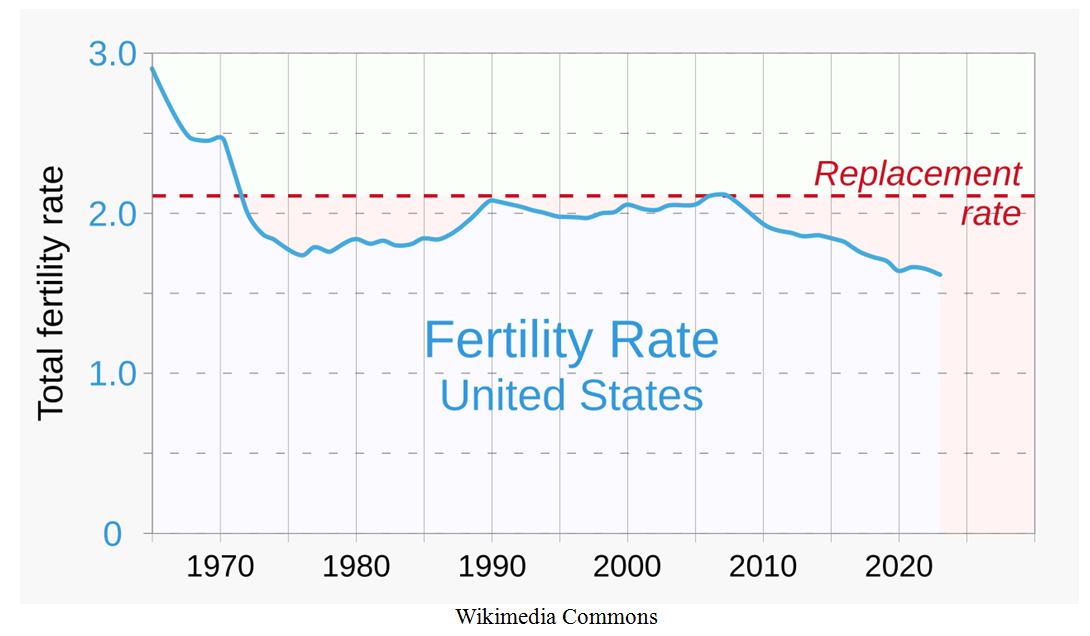

The last century shows that we tend to have fewer children when we are worried about the future, and we tend to have more children when we’re “bullish on America,” as in the FDR era (1933-43), when he said “The only thing we have to fear is fear itself,” then in the post-war Baby Boom (most intense in 1946-55) and Reagan’s “Morning in America” (the 1980s). We saw a birth dearth during and after the crash of 1929, in the peak of the cold war and stagflation (1965-75), briefly post-9/11 (2001-05), and in the global climate fear and political malaise since 2008, as reflected in these birth rate charts, above and below.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This has economic consequences, since Social Security and Medicare are financed by younger workers, so our main job is convincing Generation Z to beget children, or else nobody will fund their retirement…. Or else we need to open the borders to willing, working immigrants who are also willing to have children.

Happy 250th Birthday, America – Part I

This Friday, December 13, 2024, marks the first of several 250th birthday parties for the U.S. of A.

Why the multiple dates for our big birthday party? Freedom doesn’t come from a parchment alone – a Declaration of Independence is fine, but true freedom requires patriots risking their lives in battle.

Paul Revere had a longer, less famous ride four months before his notable Boston marathon in April 1775.

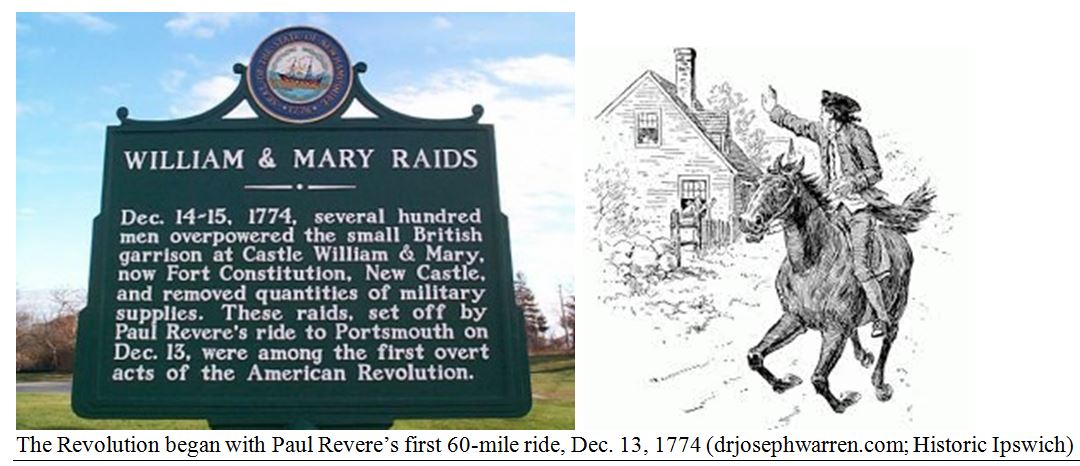

Even though there was no shooting or killing involved – no “shot heard ‘round the world” – December 14, 1774, marked the first armed battle of the American Revolution, so…Happy 250th Birthday, America.

It was a cold, icy morning on December 13, 1774 when Paul Revere began a 60-mile gallop from Boston along the Bay Road to warn citizens of Portsmouth (NH) that British troops were landing to secure their gunpowder at Fort William and Mary at New Castle, so the next day, John Langdon’s army captured the New Hampshire fort and seized the garrison’s powder, which was distributed through several towns in the colony for potential use in the looming struggle against the British Crown. The next day, December 15, 400 of John Sullivan’s raiders seized cannons that were later used in the battle of Bunker Hill in Boston.

Exactly a quarter century later, our retired general and first U.S. President George Washington braved the elements a bit too long and paid the ultimate price. On December 12, 1799, age 67, Washington spent five hours outside on his Mount Vernon farm, in a constant storm of hail and snow, amid high winds. On Friday, December 13, he awoke with a sore throat, but he went out in the afternoon sleet anyway, to mark more trees he wanted cut. At dinner that night, he was able to read aloud to his wife, Martha, and to argue politics late into the night with his secretary, Tobias Lear. But, on December 14, 1799, his throat closed, amid great and lingering pain, and this man-mountain father of his country died before the day ended.

So, all you 67-year-old Boomers, be careful shoveling snow, unless you’re as fit as George Washington.

The post 12-10-24: Happy 250th Birthday, America! To Keep Growing, Have More Kids! appeared first on Navellier.