by Bryan Perry

December 10, 2024

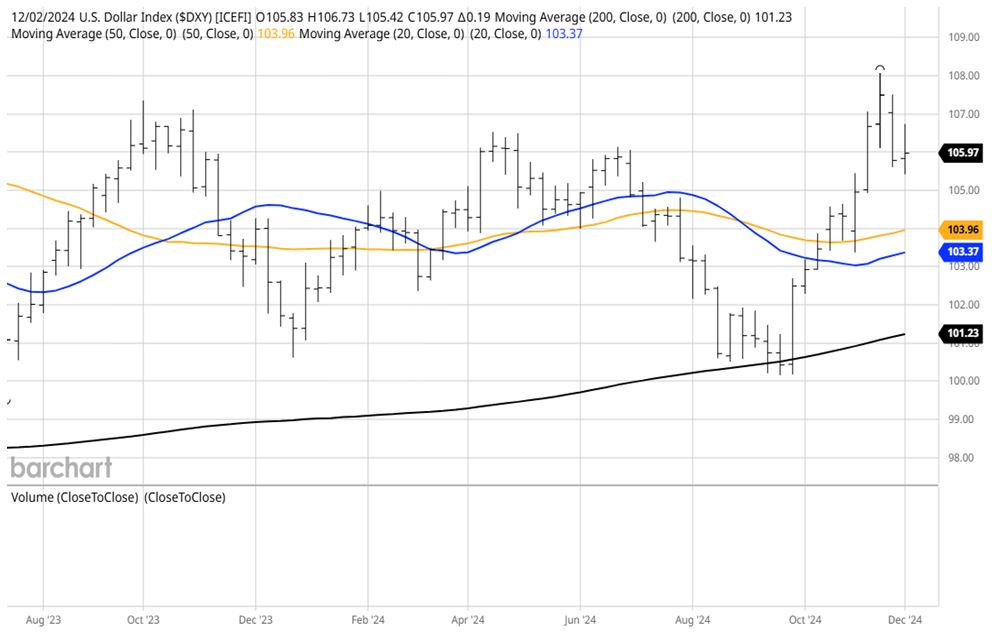

In the five weeks since the November 5th election, bond and equity markets have been bolstered by strong fund inflows across most sectors of the market universe. The U.S. is truly the oasis of investing on a global basis, with the appetite for U.S. dollar-based assets by investors remaining very robust. The notion of our government finally cutting spending, while increasing growth through deregulation has great appeal on Wall Street and is being fully embraced by Forex market participants buying dollars hand over fist.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

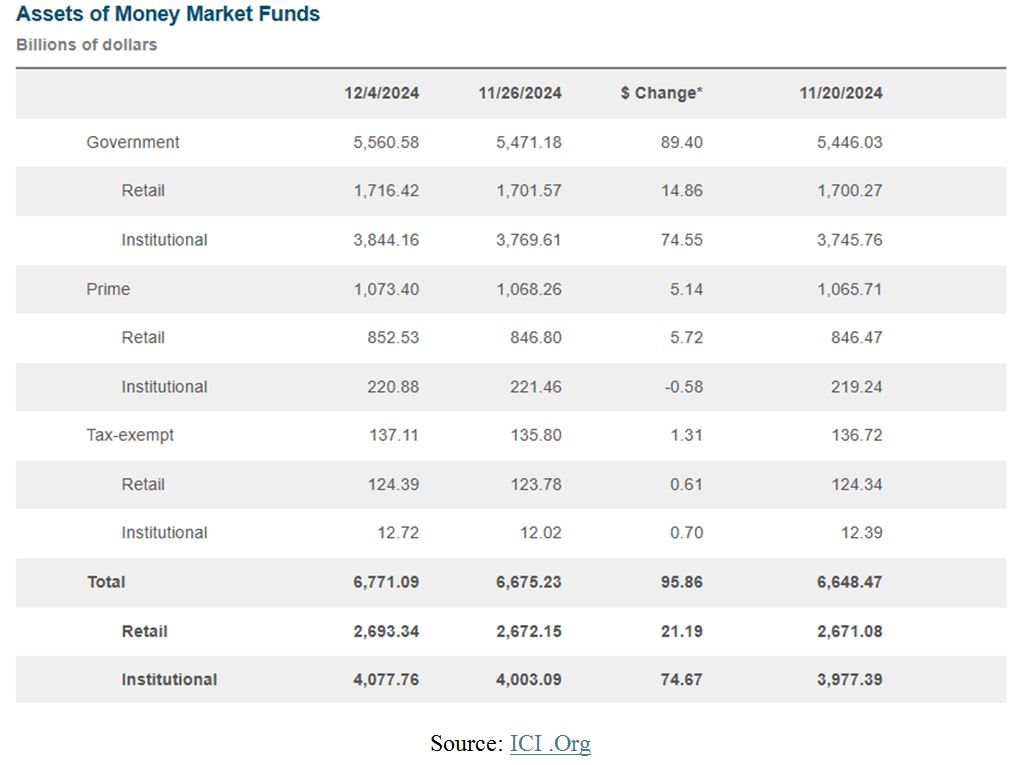

A more shocking statistic is that as the stock market has rallied to record highs and the bond market has seen the benchmark 10-year yield fall to 4.15% from 4.50%, there is still an historic amount of cash and cash equivalents sitting on the sidelines. Total money market fund assets increased by $95.86 billion to $6.77 trillion for the eight-day period ending last Wednesday, December 4, according to the Investment Company Institute. Among taxable money market funds, government funds increased by $89.40 billion and prime funds increased by $5.14 billion. Tax-exempt money market funds increased by $1.31 billion.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In light of the Fed kick-starting the rate-cutting cycle on September 18th with a 50-basis point cut, and the powerful move higher for stocks since election day, November 5th, it is remarkable that cash assets have still increased during this four-week period. The reasoning behind this cash buildup is three-fold: (1) some remaining election uncertainty that opens the door to major economic and geopolitical policy changes so as to avoid volatility, (2) waiting for clearer signals on interest rates and the risk of inflation reigniting, and (3) waiting through the lame duck period until Donald Trump and Congress are sworn in.

As a result of this procrastination, or uncertainty, nearly $6.8 trillion of dry powder remains on the sidelines, a huge force that can be deployed as some of these uncertainties resolve themselves. Granted, there are significant challenges outside U.S. borders that investors are acutely aware of, some of which seem to have no end in sight, the latest of which is the sacking of Damascus by rebel forces. Of most concern to financial markets is the slowing of the European and Chinese economies, where Europe is by definition already in a recession and China’s latest massive stimulus has not had the impact they intended.

The European Central Bank (ECB) must keep cutting rates, which will devalue the euro, and the People’s Bank of China (PBOC) will likely continue to manipulate the yuan and offer further debt payment extensions to the fragile commercial real estate market and shadow banking industry to avoid a tsunami of loan defaults. China has historically used real estate markets to stimulate the economy, but not this time.

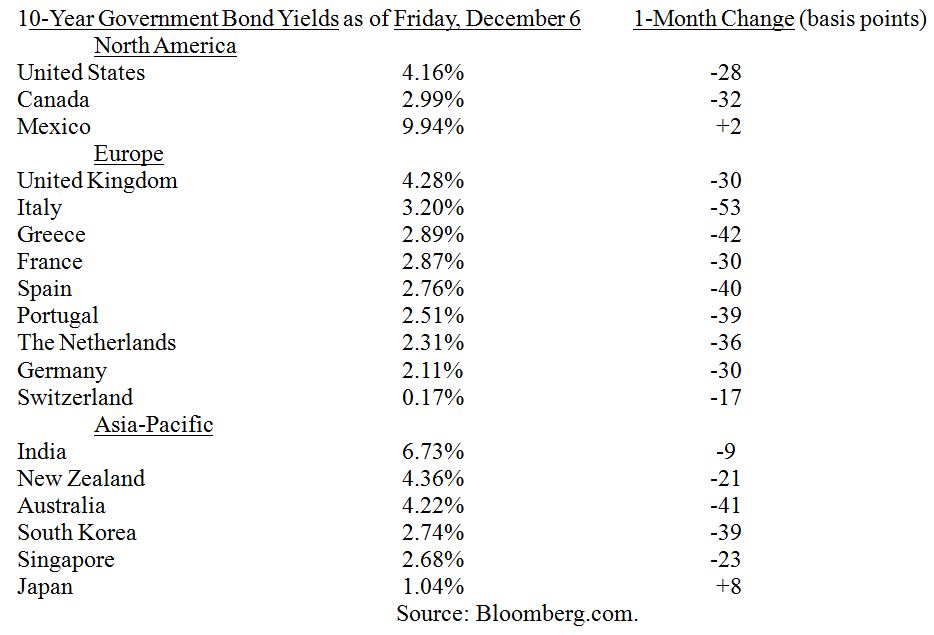

With growth in these pivotal economies outside the U.S. remaining questionable, sovereign bond yields in developed countries are lower than those in U.S. Treasuries, save for the U.K, Australia and New Zealand.

GLOBAL 10-YEAR RATES AS OF DECEMBER 6, 2024

With a renewed commitment to energy independence and a new fiscal attitude in Washington DC regarding federal budgets and debt reduction, one can easily argue that the table (above) is set for further disinflation, lower short- and long-term interest rates, and a continuation of rising asset prices in 2025.

The mountain of cash on the sidelines has been there a long time, but there is now a lot of performance pressure on fund managers who stayed out of the market for too long and are now playing catch up to show by month-end and year-end that they were weighted properly in bonds and equities. The fourth quarter and first quarter are historically where the majority of market gains are realized. This year is holding true to that pattern. The first quarter was led by Magnificent Seven stocks and the AI revolution. The second and third quarters were choppy, and the fourth quarter has seen a gem of a move up.

It is a customary practice among brokerage firms to produce new investment themes for the year ahead, but the 2024 AI bull trend is not a one-year fad, as some would believe, so 2025 will likely be another year of bullish performance for those companies building out AI infrastructure.

With the Trump administration gaining power as of January 20, there will be a push for tariffs on products made in China, Europe, and other countries where tariffs on American-made goods are high. Energy exploration will also be high on the agenda, as will shrinking the federal government. Stopping illegal migration, Fentanyl imports, child trafficking and fighting urban crime are also high on the priority list.

Staying with domestic businesses should be a primary consideration for 2025, as the world outside our borders is teeming with economic uncertainty and geopolitical risk. 2025 is set to be another good year for U.S. markets and not so much for global markets. To this point, enjoy the blessings and prosperity of 2024 expanded, rooted in American exceptionalism. Look for a bull market to continue its winning ways.

The post 12-10-24: Cash Remains at Record Highs, Despite Rallying Stocks and Falling Rates appeared first on Navellier.