by Bryan Perry

December 3, 2024

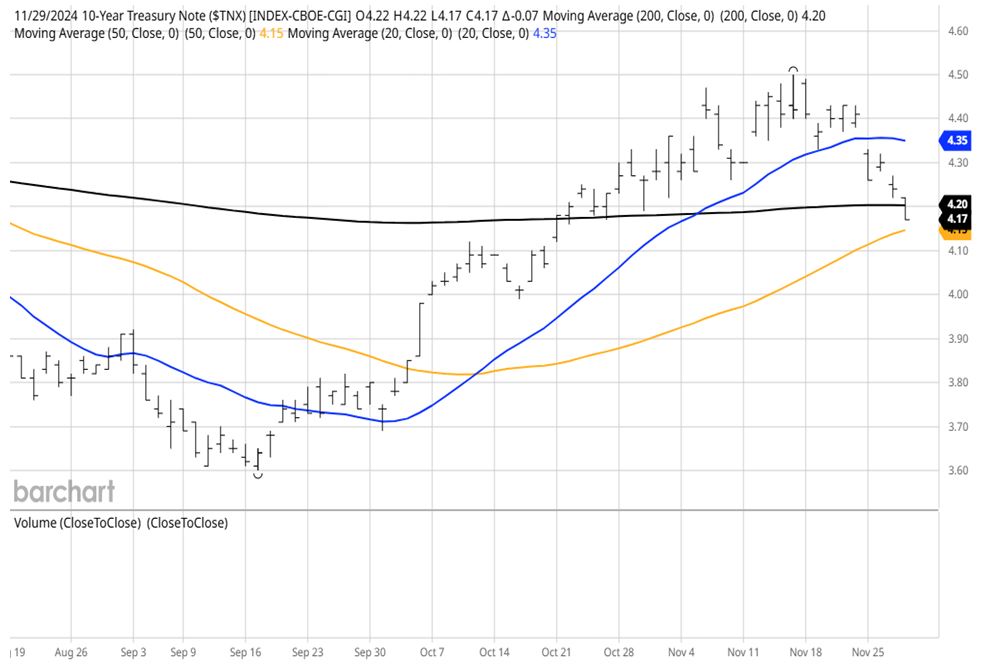

U.S. Treasuries finally had a good week of higher prices and lower yields that reversed October’s sharp sell-off, which continued into the front end of November. Prior to October, the Treasury market enjoyed five months of gains, taking the benchmark 10-year T-Note yield down to 3.60% in mid-September.

Then, the selling pressure took over amid a series of resilient economic data that sharply dialed back market expectations for more steep rate cuts from the FOMC, plus the rising odds of a second Trump presidency and fear of a return of inflation with a widening deficit under the announced Trump policies.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

During the latter part of October, expectations for another half-point cut in the Fed Funds Rate collapsed, leaving bond traders in a lurch. While they were fairly certain of a 25-basis point cut at the November 7th FOMC meeting, the notion of another quarter-point cut at the December 18th FOMC meeting has become just about a 2-1 proposition now, with the latest CME FedWatch Tool survey showing a 66% chance of a quarter-point cut to a range of 4.25%-4.50%, up from a 52.7% reading on November 22.

The renewed holiday spirit finished November on a high note with lower long-term bond yields, squarely tied to the latest set of inflation data coming in at forecast levels, supercharged by Donald Trump’s choice of Scott Bessent as Treasury Secretary, who is considered a moderate choice, a man who may temper some of the risks surrounding tariffs while also taking aim at the budget deficit that raised investor confidence about the economic outlook and government fiscal discipline. The 10-year bond yield quickly declined from 4.50% on November 15 to close out the month at 4.18% in a strong fashion.

This rebound in the bond market has removed a major headwind for the stock market that saw the S&P 500 trade to a new all-time high, with the small cap Russell 2000 jumping 8.4% in November and some fresh buying interest in mega-cap tech that had been lagging due to rising concerns of tariffs and the threat of broadening FTC investigations targeting some of the Magnificent 7 companies.

The sharp rally in bond prices is like a liquid -hydrogen-oxygen booster rocket for further stock market gains, setting the table for a continuation of higher highs for all the major averages. As of November 30, the gains for the year are impressive with the forward P/E ratio for the S&P 500 at 22.0.

Adding to the holiday cheer on Wall Street is a Bloomberg report that the Biden administration might temper some of its export restrictions on semiconductor and semiconductor equipment sales to China. While this might be temporary, investors are embracing any and all short-term bullish news to rationalize positive fund flows into beaten down sectors – such as the chip and chip equipment stocks – for a year-end run higher. This is a developing story that will gain more clarity this week.

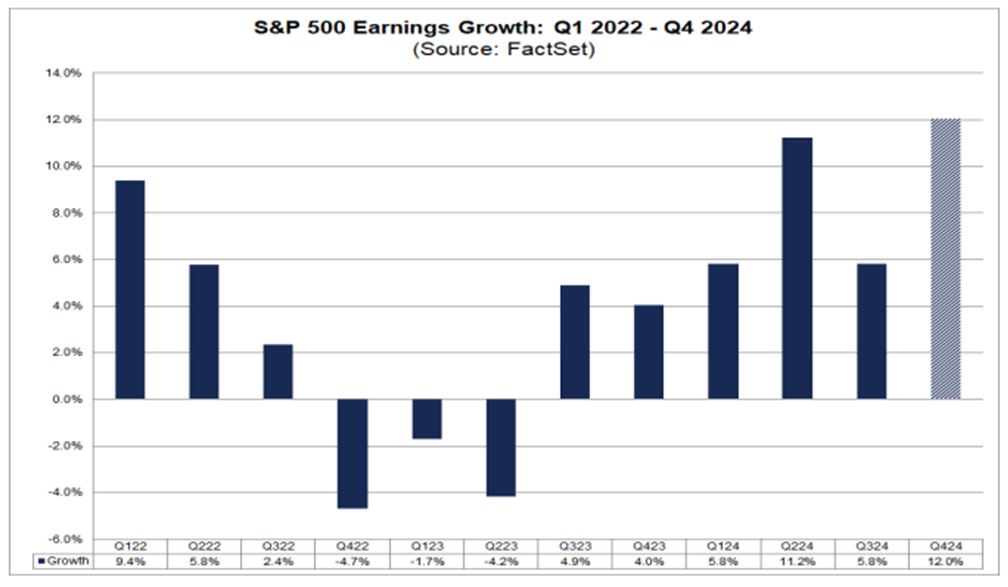

Even if the bond market takes a rest and just trades sideways into the year-end, the case for a further rally in equities is also being driven by higher expected earnings growth for the S&P 500 for Q4 2024.

According to FactSet, the estimated earnings growth rate for the S&P is expected to be 12.0%, doubling the 5.8% gains of the third quarter. If 12.0% is the actual growth rate for the quarter, it will mark the highest year-over-year earnings growth rate reported by the index since Q4 2021 (at 31.4%).

“At the sector level, eight of the eleven sectors are predicted to report year-over-year earnings growth in Q4 2024. Six of these eight sectors are expected to report double-digit earnings growth for the quarter: Financials (38.9%), Communication Services (20.7%), Information Technology (13.9%), Utilities (12.9%), Health Care (12.6%), and Consumer Discretionary (12.5%). “

“At the industry level, the five industries that are expected to be the top contributors to earnings growth for the quarter are Banks (181%), Semiconductors & Semiconductor Equipment (34%), Pharmaceuticals (64%), Interactive Media & Services (25%), and Broadline Retail (48%). Excluding these five industries, the estimated earnings growth rate for the S&P 500 for the fourth quarter would fall to 1.6% from 12.0%.” – FactSet Earnings Insight, November 22, 2024.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Few in the financial media are yet talking up this sharply higher fourth-quarter earnings story that is now unfolding and will be announced starting in mid-January. But leave no doubt that when the buzz around Q4 earnings season takes hold in the coming days, it will sound like that ancient Christmas poem:

“Investors were nestled all snug in their beds,

While visions of stock splits danced in their heads,

When out on Wall Street there arose such a clatter,

I ran to my screens to see what was the matter.”

That “clatter” on our computer screens will be the bullish pre-announcement season during the next four weeks, which should kick off an early Santa Claus rally that should deliver a joyful holiday season.

The post 12-3-24: The Bond Market is Back on Track appeared first on Navellier.