by Bryan Perry

November 26, 2024

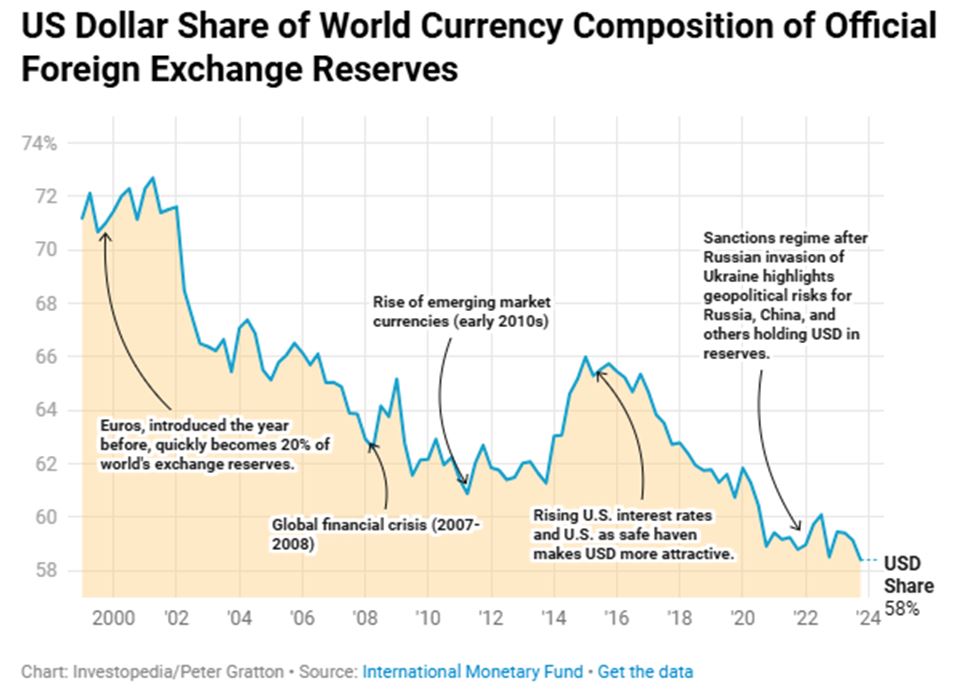

The expression “King Dollar” has long referred to the U.S. dollar’s dominance as the world’s reserve currency going back to the end of World War II, as it is the most widely used currency for international trade. Today, roughly 80% of the global oil trade is settled in U.S. dollars, with only Russia and China utilizing other currencies. Sanctions and tariffs on Russia and China are resulting in other countries opting for alternative currencies as a way of insulating themselves from the effects of further sanctions and tariffs.

William Jackson, chief emerging-markets economist at Capital Economics, told The Wall Street Journal, “Some are seeking to reduce their risk of possible sanctions on the use of dollars in trade. China is trying to act as a geopolitical counterweight.” It was reported that, as of the end of 2023, the Chinese yuan had become the fourth most popular currency for international oil settlements, overtaking the Japanese yen and highlighting the increased trading activity between Russia and China. (Source: oilprice.com)

While U.S. dollar holdings have fallen significantly over the past few decades, it remains the world’s top reserve currency, with no real rival in sight. According to the International Monetary Fund, in the first quarter of 2024, the U.S. dollar accounted for about 58% of currency reserves, significantly more than reserves held in euros (20%), Japanese yen (5.5%), British pound (4.9%), and Chinese renminbi (2.6%).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

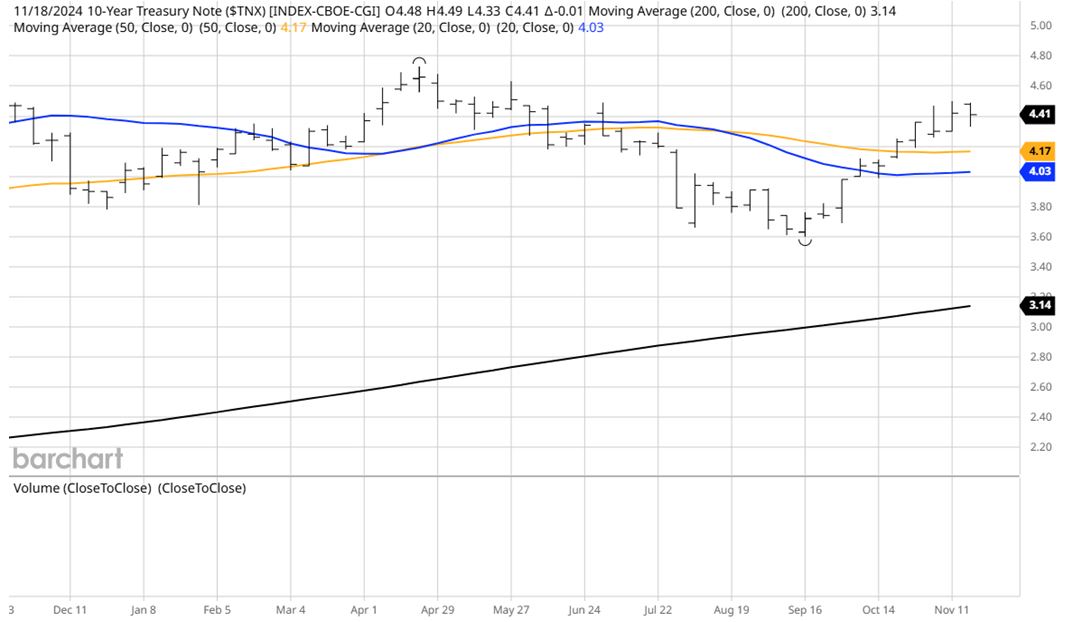

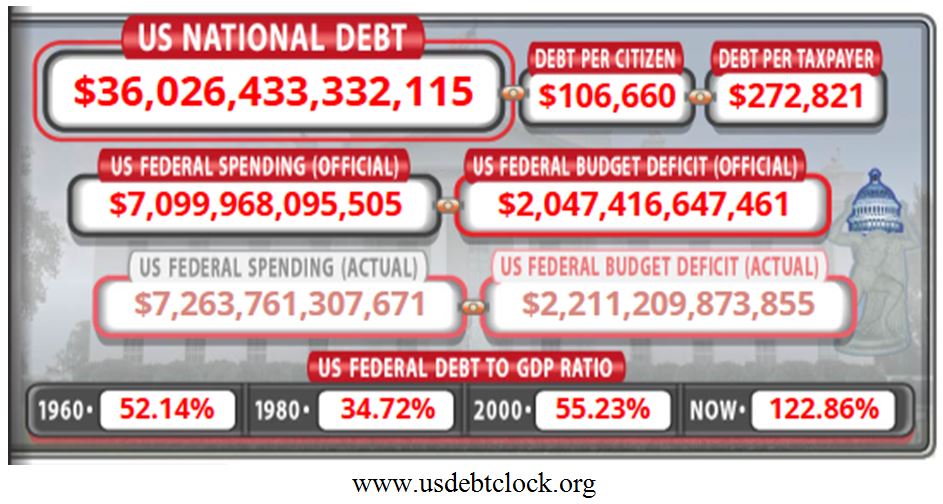

Before the recent election, the U.S. Dollar Index (DXY) was on the verge of a technical breakdown, as forex and currency traders became more concerned about the growing size of the Treasury Auctions to finance the federal budget and soaring interest on the federal debt that has now topped $36 trillion.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Around the beginning of October this year, the dollar began its torrid rally, when it became clear that the Fed was considering a less aggressive monetary policy to ease interest rates, with the U.S. economy showing solid growth, which supports the dollar. Interest rates ticked back up from the mid-September low, when the benchmark 10-year Treasury yield began its rise from 3.60% to 4.50% by mid-November.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Additionally, geopolitical tensions are ramping up, with the latest attacks by Ukraine on Russia, using U.S. made missiles, which have increased demand for the dollar as a safe-haven currency. There is also the re-election of Donald Trump and his proposed polices, such as the broader use of tariffs leading to expectations of reigniting higher inflation resulting in fewer rate cuts by the Fed. “It’s hard to short the U.S. dollar right now,” said senior market analyst Matt Simpson at City Index, given that investors are also increasingly weighing the possibility that the Fed might not cut rates next month after all.

That sentiment was driven by sharp swings in market pricing, which currently sets the odds of a Fed rate cut at its December meeting at 53%, down from 72% a week ago, according to CME’s FedWatch Tool.

But there is also a growing case that the blow torch the newly created Department of Government Efficiency (DOGE) is going to take to the bloated federal bureaucracy to eliminate $500 billion in fraud and $2 trillion in spending by July 4, 2026, when America celebrates its 250th birthday. Vivek Ramaswamy defended the cuts on X (Twitter), saying, “Over half a trillion dollars of taxpayer funds ($516 billion+) goes each year to programs that Congress has allowed to expire. There are 1,200+ programs that no longer have authorization but still receive appropriations. This is totally nuts.”

It is as if the American taxpayer is getting a wake-up call as to how unscrupulous the federal government has been with our hard-earned tax dollars. The following sample of article titles lay out some of the egregious spending that has gone on for decades. Some examples (headlines from Yahoo) include:

- Dead people mistakenly received $1.3 billion from the government owing to out-of-date records…

- The NIH is also alleged to have paid out $3.7 million in grants for a study on monkeys and gambling.

- A Russian experiment putting cats on treadmills was funded as part of $1.3 billion in US government funding funneled to rival powers, a report found.

- Federal agencies are using less than a quarter of the office space in their headquarters, a Public Buildings Reform Board report found.

- The General Services Administration spends around $2 billion a year to operate and maintain offices for the 24 government agencies and a further $5 billion to lease them.

- Megastars … received some $200 million in taxpayer money under government pandemic relief.

The notion of bringing fiscal responsibility back to Washington, where the topic of balancing the budget is reality-based and not some fantasy, is refreshing and just might be contributing to the recent strength in the dollar. Federal Debt is now at 122% of GDP, more than doubling since 2000 and unsustainable.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Imagine the government reversing course and making progress on paying down the deficit. The federal government spent $6.75 trillion in fiscal year 2024. With Social Security, health programs, and Medicare topping the spending list, they are forms of mandatory spending that would require legislation to change.

At the same time, Trump’s plans for lower corporate and personal taxes to be a catalyst for faster economic growth is a moving target, where forecasters are divided regarding what federal revenue will look like in 2025 and beyond. The jury is out on this issue, but the market is embracing the idea of more efficient government and the near-3% rally in the dollar since election-day appears to be supportive of it.

The post 11-26-24: The U.S. Dollar Is Retaking Its Kingly Throne appeared first on Navellier.