by Bryan Perry

November 12, 2024

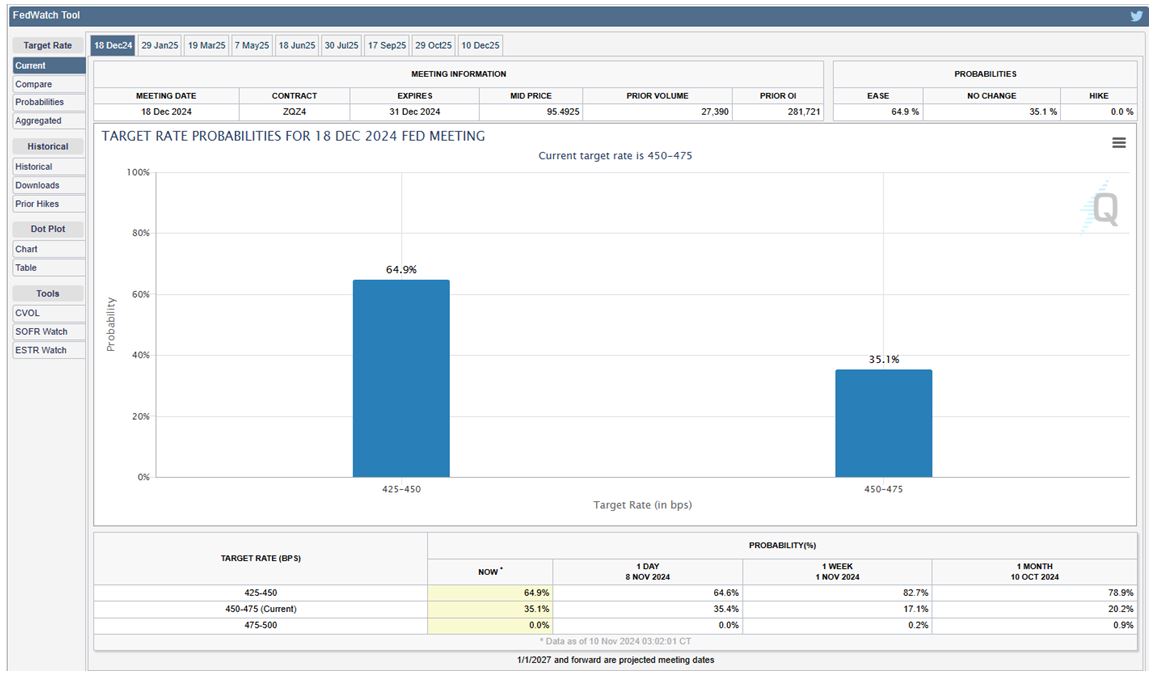

Much has changed in recent days in discussions about the prospects for aggressive rate cuts by the Fed. The economic data seems to say the consumer is faring pretty well in terms of jobs, retail sales, household wealth gains and general optimism, some of which is a byproduct of the election results. After the election, as of November 8, there is now a 65% probability of the Fed lowering the Fed funds rate by another quarter-point at the December 18 FOMC meeting. This figure is down from 82.7% a week ago.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Going out to the January 29 FOMC meeting, the odds of a rate cut are only 54%, and it isn’t until the March time-frame that the bond futures market thinks a move to the 4.00%-4.25% range will occur, assuming the economy doesn’t re-accelerate under the new pro-business Trump administration.

The case for rates remaining unchanged indefinitely is building slowly and will obviously be dependent on whether this is just a temporary thought process, or something more credible and enduring.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

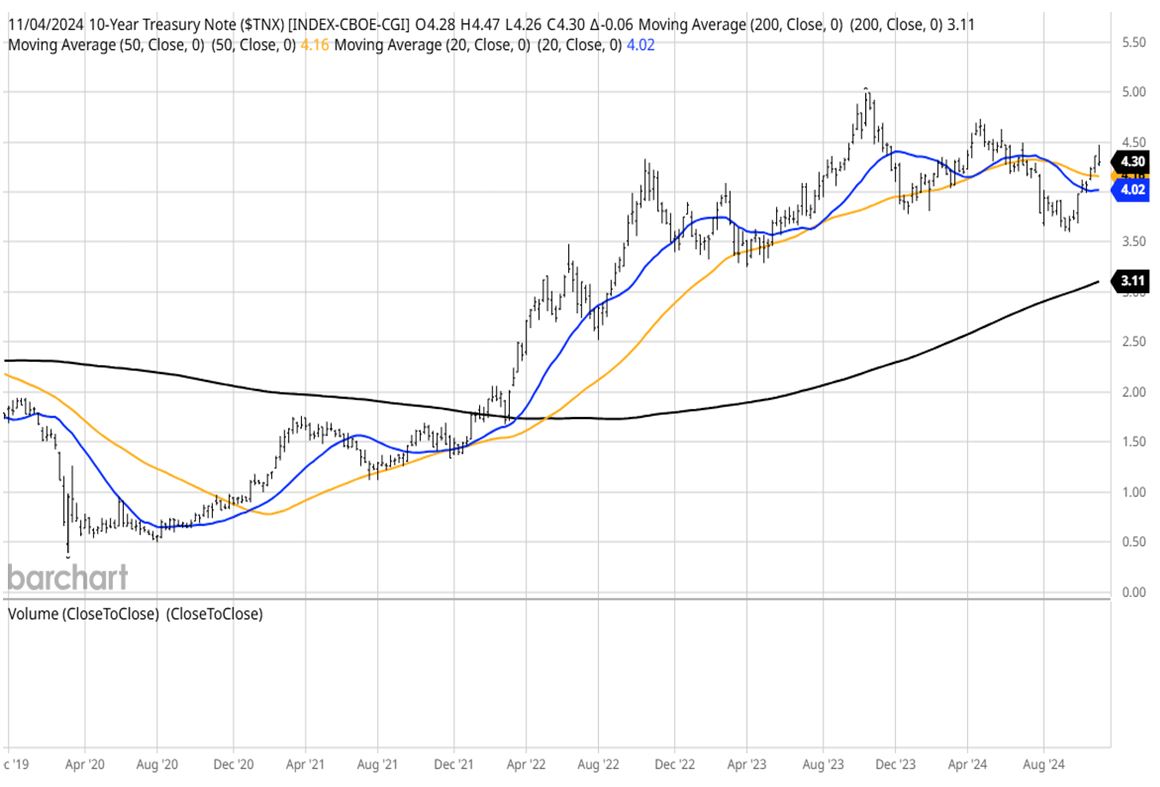

The majority of Wall Street market analysts now believe that the equity market is on a good footing and poised to add value in 2025, but not to the extent of the big gains realized in 2024. Most big brokers are forecasting 10%+ gains for the S&P next year. For income investors, this trend cuts both ways. If rates remain where they are, the potential for capital appreciation for fixed income assets is greatly diminished. On the other hand, yields at current levels allow one to roll over short-term maturities at existing yields.

However, there is a way income investors can “have their cake and eat it too” in a market where bonds trade flat and stocks rally. They can invest in convertible debt instruments, in either bonds or preferred stocks. As a refresher, convertible bonds and convertible preferred stocks are a type of corporate debt security that offers investors the option to convert into a predetermined number of common stock shares.

There are a few key points about convertible debt. Like regular bonds, convertibles pay periodic interest to the holders of convertible debt instruments. The conversion from bond to stock happens at specific times during the convertible’s life and is usually at the discretion of the owner of the convertible. A convertible is a hybrid security that has features of a bond, with the option to own the underlying stock.

Every convertible bond or convertible preferred has a “conversion ratio,” which determines how many shares of stock the bondholder or preferred holder will receive upon conversion. For example, a 5:1 ratio means one convertible bond or share of convertible preferred stock converts into five shares of common stock at a specified “conversion price.” This price is set when the conversion ratio is decided.

Convertible bond and convertible preferred debt allow investors to lock in bond yields and participate in the potential appreciation of the common stock, as they are tied to the common stock. When the common stock rallies higher, so too do the corresponding convertible securities. It is a way to get paid well while waiting for the underlying stock to make a move higher, at which time the holder of the convertible debt may elect to convert the debt into common stock, if the stock is trading at or above the conversion price.

Another consideration is that convertible bonds and convertible preferreds typically offer lower interest rates than regular bonds because of the added potential for equity participation through conversion. Convertible debt is thereby a bull market offensive strategy, whereas investing in regular bonds is a defensive strategy, so convertibles are an excellent re-balancing tool for income investors over-weighted in debt securities and desire equity market exposure without sacrificing much in overall portfolio yield.

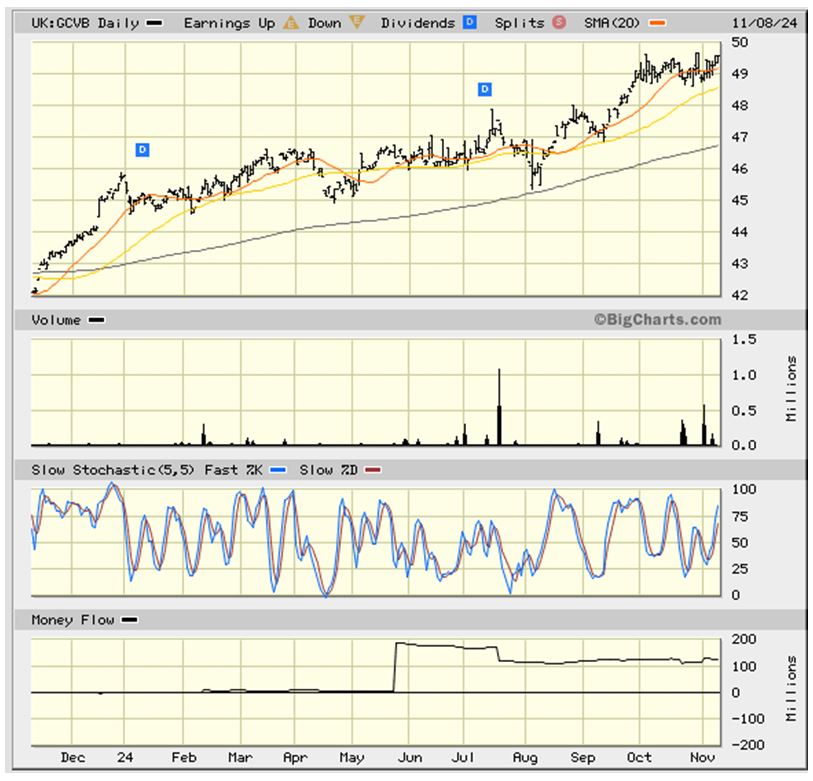

As a sector, convertible debt has gained roughly 10% so far in 2024, not including yield, which reflects their correlation to the stock market, whereas Treasuries along the spectrum of the yield curve have relinquished most of their 2024 gains with the recent selling pressure pushing regular bond prices lower.

SPDR Refinitiv Global Convertible Bond Index ETF (GCVB)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Because many convertibles trade in secondary markets and are more difficult to find and invest in, buying into convertible debt ETFs and convertible debt closed-end funds is the easiest way to gain exposure and diversification to the sector. Here are some examples of both:

- American Century Quality Convertible Securities ETF (QCON)

- iShares Convertible Bond ETF (ICVT)

- Bancroft Fund (BCV)

- Calamos Convertible Opportunities & Income Fund (CHI)

The post 11-12-24: A Compelling Case for Convertible Debt appeared first on Navellier.