by Gary Alexander

October 29, 2024

This is a week of transitions, from October to November, from Halloween to All Saint’s Day, from the worst performing six months (May to October) to the best-performing half-year (November to April), from non-stop election ads to counting the votes, from October Surprises to November Recounts, and from the Biden lame duck Presidency to someone that is both new and old, named either Harris or Trump.

These days, we are accustomed to something like wall-to-wall cable news or 24/7 internet feeds of the latest news or rumors. That trend began on this date in 1956, when two wars – resembling the recent invasion of Ukraine and the Israeli war of defense against its hostile neighbors – began in a three-day period leading up to the 1956 election, in what can only be called the Greatest of All October Surprises.

First, on Friday, October 26, 1956, the popular revolt within the Soviet-occupied People’s Republic of Hungary was brutally put down when Soviet tanks rolled into Budapest and the Molotov cocktails began flying out windows at the Soviet tanks. Three days later, on this date, Monday, October 29, a combined force of Israeli, British, and French troops invaded Egypt to topple dictator Gamal Abdel Nasser, who had recently (the previous July) seized and nationalized the Suez Canal, launching the Second Israeli War.

As a result of these two massive October surprises in the week leading up to a major U.S. election, NBC News decided to launch a new and expanded evening program with a pair of hosts, Chet Huntley and David Brinkley, for their first broadcast on this Monday night 68 years ago. Like the world today – and always – there was a lot of global tension. The Hungarian and Suez crises were in full swing, as Israel launched an attack on Egypt and its Arab allies on Chet & Dave’s debut day. General Moshe Dayan sent Israel paratroopers to seize the Gaza Strip, driving through the Sinai to the east bank of the Suez Canal.

Huntley and Brinkley picked a great week to start a news show. On October 31st, Britain and France demanded the immediate evacuation of Egypt from the Suez Canal. The next Tuesday, President Eisenhower won a convincing re-election (above), as the pallid challenger, Adlai Stevenson didn’t come through very strongly on TV – not nearly as strongly as the next Democratic candidate, John F. Kennedy.

On Tuesday, November 8, 1960, John F. Kennedy (D) narrowly defeated Richard Nixon (R), by 0.1% in popular votes, 49.7% to 49.6%, with the remainder going to Senator Harry F. Byrd, who won 15 electoral votes. But what did the losing Republican do? Challenge the vote? Storm the Capitol? Not by a long shot. He graciously bowed out and planned a later challenge. Two days later, on November 10, 1960, Nixon said he would not dispute the election, as he did not want to cause a Constitutional Crisis. He fell on his sword similarly in 1974, resigning as President instead of fighting impeachment in the Senate.

I’ll have some more relevant election night history for you next Tuesday, but let’s turn to the market.

Black Tuesday (and Tariffs) in Context –

The 1930s Didn’t Have to Be So Bad

Since today marks the 95th anniversary of Black Tuesday 1929, and there is a lot of chatter about Donald Trump (if he wins) causing high inflation or a recession with his sky-high tariffs – this might be a good time to review that “black” time in our history and see if we can learn some lessons from 95 autumns ago.

First came Black Thursday, October 24th. Sell orders piled up the night before, and Thursday opened in panic selling at any price. Terrified investors sold a record 13 million shares. The panic was stemmed at 1:30, when Richard Whitney, director of the Exchange, stepped to the center of the floor and said in a booming voice, “I will buy 10,000 shares of U.S. Steel at $205.” J.P. Morgan, Jr. and other wealthy investors then joined the buyers, saying this was just a passing phase – a brief correction. But the ticker tape did not stop chugging out transaction prices until 7:08 p.m., well into the New York night.

Monday, October 28 was the worst day (in percentage terms) in market history to that date – and the second worst day came the next day, Black Tuesday, October 29th. That’s what made Tuesday the killer date – it came as the second horrible day in a row, and the third Black day out of four. Monday’s drop was the worst day of 1929. The Dow fell 13.5%, from 301 to 260, and Black Tuesday’s drop was -11.7%.

The Dow fell 30.57 points to 230 on Black Tuesday. That two-day 71-point drop amounted to -23.6%, or more than on October 19, 1987 (-22.6%). On Black Tuesday alone, a record 16.4 million shares traded hands, as huge blocks of blue-chip stocks were traded for “whatever price they will bring.” In contrast,

Wednesday, October 30 was the third best day in market history, on a percentage basis, +12.3%, up 28.4 points to 258.47, within a whisker of Monday’s close, but the low came November 13, under Dow 200.

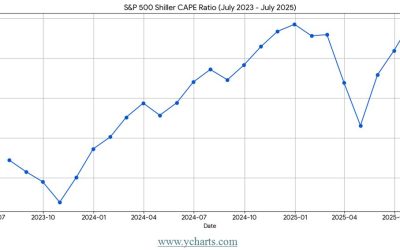

From its peak of 381.17 on September 3, 1929, the Dow Jones Industrials lost 48% in 10 weeks, reaching 198.69 on November 13, 1929. But then came a 48% recovery in five months. By April 17, 1930, the Dow climbed all the way back to 294.07, reaching its 1928, pre “bubble” levels. But that day was the start of the “real” crash, an 86% drop in the next 27 months due to a tariff bill grinding through Congress that spring.

In hindsight, the 1929 crash did not need to beget a Great Depression, but several political blunders in 1930 (mainly, Federal Reserve tightening, freezing wages in a time of deflation and the Smoot-Hawley tariffs) turned a normal stock market correction into something incredibly more severe by 1932.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In hopes of reviving the economy, Congress drafted a protectionist trade document, named after Senator Reed Smoot and Rep. Willis Hawley. In a desire to preserve the domestic market for American-made goods, they raised duties on imports to astronomical heights. By early May, the bill was set to pass, but on May 4, 1930, 1,028 economists signed a petition that protested these tariffs. It didn’t work. The Smoot-Hawley bill was signed into law on June 17. The 1,028 economists proved prophetic, as several foreign nations retaliated against by passing their own tariffs, which deepened into a global Depression.

Looking forward, there is always danger of a modern trade war, but Trump’s few and targeted tariffs in his first term did not cause inflation or a trade war, and most of our allies have sky-high tariffs that need to come down. But 2024 is a different world than 1930, when trade barriers were far higher than now:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Trump has admittedly used threats of tariffs as bargaining chips to gain favorable advantages, with the intention of rescinding those tariffs when competitors trade more fairly. He can institute some targeted tariffs by executive fiat, but across-the-board tariffs, like Smoot-Hawley, must be passed by Congress, and that may be difficult, as Congress is likely to be mixed in composition and will not be rubber-stamp.

The post 10-29-24: Welcome to Transition Week – NOVEMBER, Here We Come! appeared first on Navellier.