by Ivan Martchev

October 22, 2024

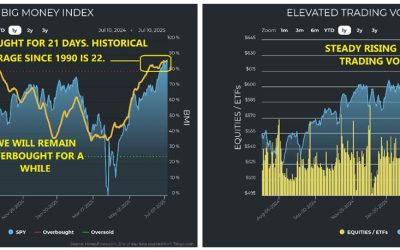

The stock market is acting like the weatherman (played by Bill Murray) in the movie “Groundhog Day.” He is covering the annual Groundhog Day event in Punxsutawney, Pennsylvania but becomes trapped in a time loop, forcing him to relive one specific February 2nd repeatedly. In today’s replay, the market has risen every week after the first week of September, with no two back-to-back down days in the S&P 500 since that time. The stock market is gliding higher, waiting for a catalyst to move one way or the other.

After the Fed’s September 18th rate cut, the biggest catalyst is now the U.S. election, which historically has typically moved markets to the upside. The other obvious catalyst is the pending Israeli retaliation on Iran, which we all hope comes before the election and is contained to a one-day event. Nobody wants to turn that into a regional war, as it has unfortunate implications for crude oil and risk assets in general.

We are certainly due for a down week, but we need a catalyst and, other than the two obvious catalysts described in the above paragraph, it is unknowable at this point what any third catalyst might be. When the economy is growing and there is a lack of bad news, the stock market typically grinds higher.

Nvidia is a Market Leader and Indicator

I previously pointed out that Nvidia (NVDA) has become a stock market indicator in and of itself. On days that this stock is up, the NASDAQ 100 Index is typically up, and on days the stock is down more than a percent or two, that index is typically down. This is because NVDA’s market cap is over $3 trillion, and it drags all the other major companies involved in the acceleration of AI infrastructure with it – which is to say most of the big components of the NASDAQ 100 Index. So, what is NVDA stock doing these days?

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

As this chart shows, NVDA appears to be consolidating the gains it delivered in the first part of 2024, and the NASDAQ 100 Index appears to be doing the same, as it had not moved past the July highs while the broad market is above those July highs. In fact, NVDA appears to be consolidating the same way it did in the early fall in 2023. After this consolidation is over, the stock will probably move higher as demand for its AI chip-sets is “insane,” as per the CEO’s recent statements. They sell them as fast as they can make them, and NVDA appears to be accelerating the chip architecture update cycle in order to boost sales.

If there is no slowdown in sales when the company reports earnings in November, further acceleration of manufacturing constraints permitting, its shares are likely to levitate above $140 and drag the whole stock market with it. The stock looks slated to become the biggest company in the world by market cap, as it grows faster than either Microsoft or Apple, yet it doesn’t have a more expensive valuation multiple.

The issue I have with Nvidia is that it does not have as diversified a business model as either Microsoft or Apple, but I suppose this is why its multiple is relatively lower for the much faster growth it is delivering. All those concerns are well understood by its CEO, and I am sure he is taking steps to address them.

The exact opposite of NVDA’s success is the disaster that Intel (INTC) is. If there were a case of falling asleep at the switch in chip architecture new trends, Intel is it. AMD started to make faster and better CPU chips (cheaper by performance) a long time ago. NVDA has decimated Intel with its AI infrastructure. As far as I know, AMD is ahead of Intel in AI development, too. It seems to me that Intel is in need of new management and a change of direction, as the present CEO is failing, as well as the one before him.

Navellier & Associates owns Microsoft (MSFT), Apple Computer (AAPL), Intel Corp (INTC), Advanced Micro Devices, Inc. (AMD), and Nvidia Corp (NVDA), in managed accounts. Ivan Martchev does not personally own Microsoft (MSFT), Apple Computer (AAPL), Intel Corp (INTC), Advanced Micro Devices, Inc. (AMD), and Nvidia Corp (NVDA).

The post 10-22-24: It’s Groundhog Day (Again) in the Stock Market appeared first on Navellier.