by Louis Navellier

October 15, 2024

Last Thursday, Elon Musk announced Tesla’s Robotaxi, which includes an innovative design with no steering wheel or pedals. This was a well-choreographed event that also introduced a Robovan that can carry up to 20 people and/or deliver cargo. Musk also introduced Optimus, a robot that served drinks at the event and was pitched as a robot that could do several household chores, including walking a dog.

Overall, this event was presented as a bold vision into the future that appeared to be very realistic and believable, even though this Optimus robot may take a decade or more before rolling out in the future.

Interestingly, Tesla’s Taxi and Van rely on cameras versus lidar (which senses heat, like pedestrians and animals) for its autonomous vehicles. The Robotaxi is a big deal and will be rolled out in California and Texas for testing, just like the Waymo taxis are all over San Francisco. Autonomous driving is here to stay. So far, the best system I have used is GM’s Super Cruise, which only works on selected highways.

City driving is more challenging to an autonomous driving system than the open road, so if Tesla’s Robotaxi catches on in Austin and San Francisco, I expect it to be a big success! But Tesla’s stock sold off in the wake of the Robotaxi event, since apparently it will not boost the company’s near-term earnings.

Meanwhile, that Other Hemisphere is Still at War

In other news, that the other hemisphere – as in Russia/Ukraine and the Middle East – remains at war.

One potential “October Surprise” would be if Israel retaliates against Iran for its recent missile attack, since war in the Middle East would push crude oil prices higher in advance of the election. The Biden Administration told Israel not to strike Iran’s nuclear facilities or its oil fields and infrastructure, since rising oil prices before an election could cost Kamala Harris the White House. Frankly, I would not be surprised if Israel struck the Iranian Republican Guard’s facilities, and possibly its nuclear facilities.

Since any attack on Iran could last several days, the missile launching sites and Republican Guard targets would likely be hit first and then, if Iran’s defenses are degraded, Israel could then hit multiple Iranian nuclear facilities in a “grand finale” event. In the meantime, The Wall Street Journal reported that the Biden Administration is frustrated that Israel is not telling the U.S. how it plans to retaliate against Iran, probably because Israel no longer trusts the Biden Administration to support its boldest military plans.

French President Emmanuel Macron called for a halt to all arms supplies to Israel, which caused Prime Minister Benjamin Netanyahu to issue a sharp rebuke. Specifically, Netanyahu said, “As Israel fights the forces of barbarism led by Iran, all civilized countries should stand firmly by Israel’s side. Yet, President Macron and other Western leaders are now calling for arms embargoes against Israel. Shame on them.”

Crude oil prices are now moderating as Israel takes its time to retaliate against Iran. Furthermore, the Energy Information Agency (EIA) lowered its forecast for crude oil demand in 2025 to a 2.5% rise, down from its previous forecast of a 3.2% increase. The EIA now forecasts that U.S. crude oil production will rise to a record 13.54 million barrels per day in 2025. Interestingly, the number of oil rigs operating in the U.S. is now at the lowest level since 2021, but low rig counts are more efficient than ever due to horizontal drilling. Still, many shale producers may curtail their production if crude oil prices decline too far.

Finally, Reuters reported last Tuesday that global natural gas demand rose to a new high in 2024. In the first nine months of 2024, natural gas-fired electricity generation accounted for a record 46% of electricity generation in the U.S., up 5% compared to the same period in 2023. The retirement of coal-fired electric plants, plus growing demand for electricity from data centers and electric vehicles (EVs), is anticipated to cause natural gas demand to steadily rise. Although the green community often views natural gas as a “transition fuel,” since natural gas-fired electricity is so much cheaper than many green alternatives, natural gas demand will likely steadily rise as long as consumers are getting “shocked” by their electric bills in many blue states. I should also add that cheap electricity from natural gas provides the U.S. with a huge competitive advantage in manufacturing states, especially in the Midwest and the South.

The Latest Consumer Price Index (CPI) Rise May Have Pushed Treasury Rates Higher

Last Thursday, the Labor Department reported that the September Consumer Price Index (CPI) rose 0.2% and 2.4% in the past 12 months, slightly higher than consensus expectations. The core CPI, excluding food and energy, rose by 0.3% in September and 3.3% in the past 12 months, also above consensus expectations, even though owners’ equivalent rent (shelter costs) rose by a slower 0.2% in September.

The other big news released on Thursday was that new unemployment claims rose to 258,000 – much higher than expected. Since the Fed is now more worried about the labor market than inflation, I’d say that a 0.25% key interest rate cut is fully anticipated two days after the November Presidential election.

On Friday, the Labor Department announced a more moderate rise in the Producer Price Index (PPI). September prices remained unchanged, and the 12-month increase was just 1.8%. The core PPI, excluding food and energy, rose 0.2% in September and 2.8% in the past 12 months. Overall, the PPI continued the positive inflation news, but rising inflation seems to have pushed Treasury yields up over 4% last week.

The FOMC minutes were also released on Wednesday, revealing that there was some infighting in the September meeting, since a vocal minority only wanted to cut key interest rates 0.25% versus the 0.5% cut the Fed announced on September 18th. The most important indicator to watch now are market-rates, since the Fed does not like to fight market forces. Although the 10-year Treasury bond yield has risen 50 basis points in the past four weeks, the 2-year Treasury note has only risen by 35 basis points, and the Fed is ultra-focused on the short end of the Treasury yield curve, so I would assume that the Fed will continue to cut its Fed funds rate until that benchmark rate is just slightly above short-term Treasury yields.

Earnings Season Begins This Week, Likely Lifting Many of Our Stocks

J.P. Morgan kicked off the third-quarter announcement season with better-than-expected quarterly results and positive guidance. However, J.P. Morgan CEO Jamie Dimon warned that geopolitical conditions are “treacherous and getting worse,” adding that the outcome of events could have “far-reaching effects on both short-term economic outcomes and, more importantly, on the course of history.” However, on the financial side, the Treasury yield curve is now very favorable to banks, so I expect more banks to issue upbeat guidance. I also suspect that some banks may boost loan loss reserves, since the Philadelphia Fed has been reporting that 30-, 60- and 90-day loan delinquencies have been increasing in recent months.

Turning to our companies, Super Micro Computer (SMCI) announced that it shipped a record 100,000 GPUs with liquid cooling in its most recent quarter. This caused a short covering rally and helped to lift Nvidia, which supplies Super Micro Computer with its regenerative AI chips. Super Micro Computer’s latest quarter sales are forecasted to rise 212.7%, while its earnings are forecasted to increase 120.6%.

The election is still too close to call. Donald Trump has been gaining strength in some key swing states. Real Clear Politics now has Trump winning the Electoral College by 302 to 236. Just a couple weeks ago, Real Clear Politics had Kamala Harris winning. As Election Day approaches, it appears to be increasingly boiling down to James Carville’s famous phrase, “It’s the economy, stupid,” and the economy looks good.

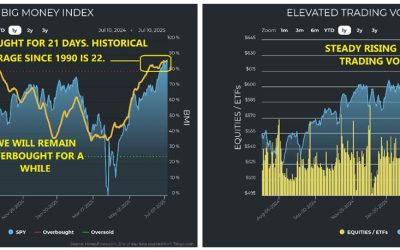

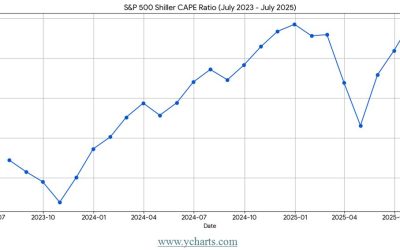

One interesting development is that M2 money supply (cash and savings accounts, excluding retirement accounts and CDs above $100,000) has surged in recent months. The stock market is closely correlated to M2, so as money supply surges, the stock market has historically risen impressively, so with economic uncertainty diminishing (as the Fed continues to cut key interest rates) and political uncertainty diminishing (as the Presidential election is only three weeks away), I believe the stock market is poised to rally.

Navellier & Associates owns JPMorgan Chase (JPM), Super Micro Computer, Inc. (SMCI), and Nvidia Corp (NVDA) in managed accounts. A few accounts own Tesla (TSLA) per client request. Louis Navellier and his family own Super Micro Computer, Inc. (SMCI), and Nvidia Corp (NVDA), via a Navellier managed account, and Nvidia Corp (NVDA), in a personal account. He does not personally own Tesla (TSLA), or JPMorgan Chase (JPM).

The post 10-15-24: The Futuristic World of “Robotaxi” is Finally Here appeared first on Navellier.