by Bryan Perry

October 1, 2024

As we go to press, the port strike scheduled to take place at midnight Monday is still set to happen. The contract for 45,000 longshoremen and port workers is set to expire at the end of day on September 30, and as of mid-day Monday, there is no deal between the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX), so roughly 36 ports from Texas to Maine will shut down, including the Port of New York and New Jersey, the nation’s third-largest port by volume handled.

If the strike is short, the cost is likely to be limited, said Patrick Anderson, president of Anderson Economic Group, a Michigan research firm with expertise in estimating the cost of trade disruptions, such as work stoppages, but a prolonged strike of 2-3 weeks or more could deliver a severe economic blow, where the effects would be felt well into 2025. “We would be in uncharted territory,” he said.

At the center of the contractual impasse are higher wages to adjust for inflation and the threat of AI-driven automation that could eventually eliminate tens of millions of jobs globally. The ILA union wants a 77% increase in wages spread over the next six years and wants the USMX port operators to cease the implementation of automation that comes in the form of robots and computerized loading, transfer, and storage of cargo. Port operators seek to limit their vulnerabilities to labor troubles, and union workers seek to save their livelihoods, so the threat to disrupt international commerce this week is very real.

(Even if this week’s strike doesn’t occur, something like it is likely to eventually happen, as AI expands).

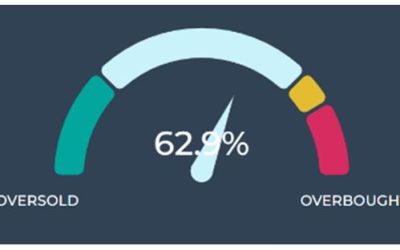

CNN reported that USMX has offered upwards of 40% in wage increases over the six-year contract. The ILA is reportedly asking for raises of $5 an hour per year for six years, which would be an immediate 12.8% pay hike on the current top pay rate of $39 an hour. Repeating that $5 per hour increase each year would result in raises totaling 77% during the life of the contract. The ILA also wants to share in the profits that shippers have reaped, with rates more than doubling in a year (see chart, below):

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

For all its potential to achieve greater efficiencies, artificial intelligence – or AI – could, by estimates, eliminate large swaths of various work-forces globally. According to a report by Goldman Sachs, AI could potentially replace the equivalent of 300 million full-time jobs while creating a boom in productivity for multiple industries – such as logistics and freight management at America’s busiest ports.

The application of Robot Process Automation (RPA), Machine Learning (ML) and Cognitive Automation are all part of Intelligent AI, or AI automation, none of which requires higher wages for overtime, paid time off, workers’ compensation, vacation time off, sick leave, family health insurance, disability insurance or pensions and matching 401K contributions. These technologies work together to enhance operational efficiency, reduce errors and work-related injuries, thereby driving operational costs lower.

For the ILA union to demand the USMX port operators ban the implementation of advanced technologies is just not going to be a part of any final agreement as I see it. If it were just about wages, then sure, it stands to reason that a new contract could be hammered out, as was the case in the United Auto Workers (UAW) strike, the Hollywood strike, the Kaiser Permanente strike, and the hotel workers’ strike, but in the UAW and Hollywood strikes, job security at the expense of AI was also part of the negotiations.

Assuming the USMX does not budge on its intentions to implement technological advancements to operate the nation’s ports, and the strike becomes prolonged, the economic impact could become significant. Supply chain disruptions will lead to delays and increased costs that will be passed on to consumers and could cost the economy $5 billion per day, according to a report by JPMorgan, since ports on the East Coast and Gulf of Mexico account for more than half of all U.S. container imports.

“The supply chain will start to get shocked after a couple of weeks,” Adam Kamins, a senior director of economic research at Moody’s Analytics, told ABC News. “If it gets beyond that, we’ll start to see some much more significant implications.” President Joe Biden retains the power to prevent or halt a strike under the 1947 Taft-Hartley Act that puts into place an 80-day cooling off period. In a statement, a White House spokesperson said the Biden administration does not intend to intervene but is “monitoring and assessing” ways to address the potential impact of a strike for the nation’s supply chain.

The imports most immediately affected include fresh fruits and vegetables. Bananas, of which 75% come through the East and Gulf ports, cannot be rerouted. A significant share of the nation’s imported auto parts, clothing and apparel, consumer electronics, toys and holiday-related products could see delays.

In 2002, a strike among workers at West Coast ports lasted 11 days before then-President George W. Bush invoked the Taft-Hartley Act to end the stand-off. However, the last time East and Gulf Coast workers went on strike, in 1977, the work stoppage lasted seven weeks.

“Strikes are never easy,” said Dennis A. Daggett, executive vice president of the International Longshoremen’s Association, “But in today’s world, with labor laws stacked against us and corporate greed at an all-time high, it remains one of the most powerful tools we have in our fight for justice.”

While there is still hope for a timely resolution, the USMX and the ILA haven’t met since June, and as of this weekend, no talks were scheduled. Last Thursday, the USMX filed an unfair labor practice complaint with the National Labor Relations Board, seeking to get the union back to the table, to no effect so far.

From the pandemic days, it became crystal clear how fragile and intertwined the global supply chain has become. Given the market’s upbeat tone last week, investors don’t seem to think the ILA’s bark has much bite. The market seems to assume the government will intervene. However, if the Biden administration does not get involved fairly soon, the stock and bond rallies could hit a speed bump heading into earnings season and make for what could be an attractive opportunity to buy the dip in the market’s leading stocks.

The post 10-1-24: This Port Strike Pits Longshoremen Against AI appeared first on Navellier.